AAX is the first cryptocurrency exchange to be powered by London Stock Exchange Group’s technology provider LSEG Technology. It is also the first cryptocurrency exchange that joined London Stock Exchange Group’s Partner Platform, providing institutional clients ease of access to the crypto market.

Market Demand:

Crypto’s $800 billion dollar market cap at the end of 2017 was certainly impressive, but it’s nothing compared to what’s possible when we further connect crypto to traditional markets. Imagine what happens once we really start tapping into the $8 trillion dollar gold market or the world’s $80 trillion dollar stock markets.

In little over two weeks, AAX has increased its user base by 100%, and has now passed the 200k mark in user registrations.

AAX token allow crypto exchange to strengthen its business model, differentiate themselves, offer their customers exclusive benefits and, by doing so, build customer loyalty with a real sense of community.

Offering OTC, Spot, and Futures trading, quoting more than 50 cryptocurrency pairs and listing 5 perpetual futures contracts for Bitcoin, Ether, Litecoin, Ripple, and EOS, which can be traded with up to 100x leverage, AAX provides a secure, deeply liquid, ultra-low latency and fully compliant trading platform.

The token offers:

A multi-tiered discount scheme - Settling trading fees with AAB is rewarded with a 20% discount, and a further discount is granted in proportion to how much AAB clients hold relative to their overall portfolio.

Optimized wealth management - AAB will be used in special promotions that make lending, borrowing, staking, and saving,even more attractive.

Platform upgrades - AAB can be used to unlock exclusive services and facilities, trading bots and trading signals,and other premium offerings.

Pioneer program - AAB will be the key token to gain access to AAX’s pioneering financial products and programs, including index derivatives, tokenized commodities, security tokens, and social trading schemes.

The Team

Thor Chan is the CEO. Thor was among the first to join AAX and is the mastermind behind the company's product development strategy. His experience includes building global order management systems, global settlement systems, and low-latency trading platforms for professional traders. He was previously licensed in Hong Kong to manage equities and derivatives brokerage and trading operations. He's held various roles, including Deputy COO at FDT Group, and product management roles at AppAnnie, Microsoft, Publicis, and HSBC.

Lead Advisor is Jamie Khurshid, CEO at Match Financial Limited. Voted by Financial News as one of the top 40 under40 in trading and technology (2014) and ranked in the ‘Exchange invest’ Top 1000 most influential people in global financial markets 2017, Jamie worked between New York and London at investment firms GoldmanSachs, Credit Suisse and The Royal Bank of Scotland with responsibility for new business, regulation, product development and strategic investments.

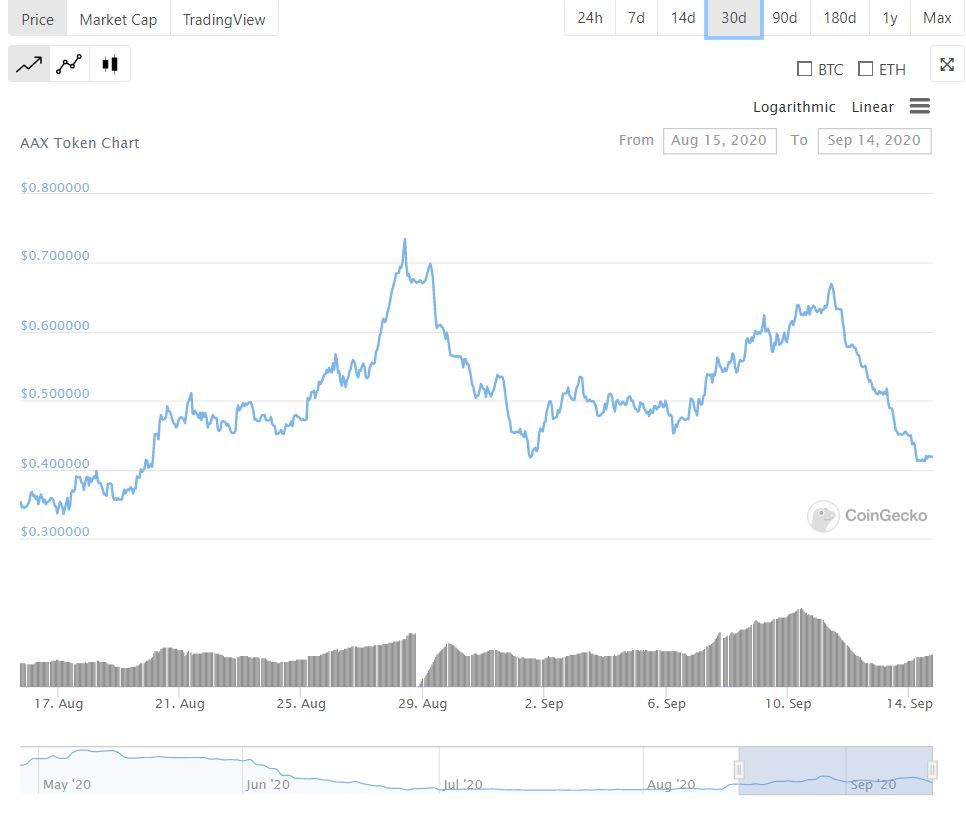

Price Analysis for AAX Token (AAB)

It has max supply of 50 Million coins (1 BTC = 20362.34 AAB). It is worth noting that the deflation mechanism peculiar to AAB entails the daily buyback and burning of tokens with the revenue generated from the exchange’s futures markets. As such, the surge in engagement and trade volumes translate to more revenue, which means more fund is available to sustain the price of AAB. AAX is conducting daily coin burns funded by 100% of the derivatives revenue. This process will continue until 50% of the total supply of AAB is destroyed.

All-Time High was $1.73 four months ago and is down -70.3% compared to the current price of $0.418954. All-Time Low was $0.139807 two months ago and is up 266% compared to the current price. 24-hour trading volume is $8,834,859

Based on the 30-Day chart, we can notice a cup and handle price pattern. The cup and handle is considered a bullish signal, with the right-hand side of the pattern typically experiencing lower trading volume. We can expect $0.73 level very soon.

AAX exchange is the current most active market trading it.

Upcoming Events

- Wealth management, part 2:lending, staking

- Bitcoin dimensions contracts

- Additional indices

- Multi-asset as collateral for trading

- Quarterly futures

- Social trading and trading bot

- Margin trading

- Options

- AAB futures contracts

Should I buy AAX Token (AAB)?

Token’s deflation mechanism, its strong ties with a budding crypto exchange, and its wide range of use cases shows that AAB is one of the most promising digital assets available today.

Should you buy into this token? Investing is a personal choice and investors should consult with experts when making financial decisions. It's important to note cryptocurrencies are highly volatile, unregulated and have the potential to go to zero. If this doesn't discourage you and would like to know if the AAX Token made it to our shortlist, check out our weekly Altcoin Reports.

Read Our Latest Reports...

If you enjoyed this analysis you can read our weekly updates in our Altcoin Report, published every Sunday. In these reports we cover our altcoin findings for the week.

Disclaimer:

The information in this review has been independently sourced and even though we have made the best attempts to report accurately, we do not provide assurances on any of this information. This analysis is provided "as is" and it is up to the reader to do their own due diligence and research. Altcoin Investor is not associated or affiliated with any firm and the opinions are strictly that of the author. This information should not be relied nor is it to be treated as financial advice.