Fiat money is a government-issued currency that is not backed by any physical commodity (such as gold or silver) but rather by the government that issued it.

The valuation of fiat money is determined by the confidence the public and the financial institutions that use the fiat currency have in the issuing government, rather than any commodity or asset backing it.

The word "fiat" comes from Latin, often translated as "it shall be" or "let it be done". There are no assets or commodities supporting the value of fiat currencies other than the value the government ascribes to them, supported by confidence in the issuing government.

History of Fiat Currency

Fiat money is a relatively new concept as most government currencies were previously backed by commodities or assets such as Gold or Silver. Prior to 1933 (with the passage of the Emergency Banking Act of 1933), the US dollar was backed by gold, which completely ended in 1971.

Fiat Money Leads to Hyperinflation

All government currencies, given enough time have fallen to zero. The greatest threat to the use of fiat money is the resultant hyperinflation that occurs when a country prints its own money without restriction.

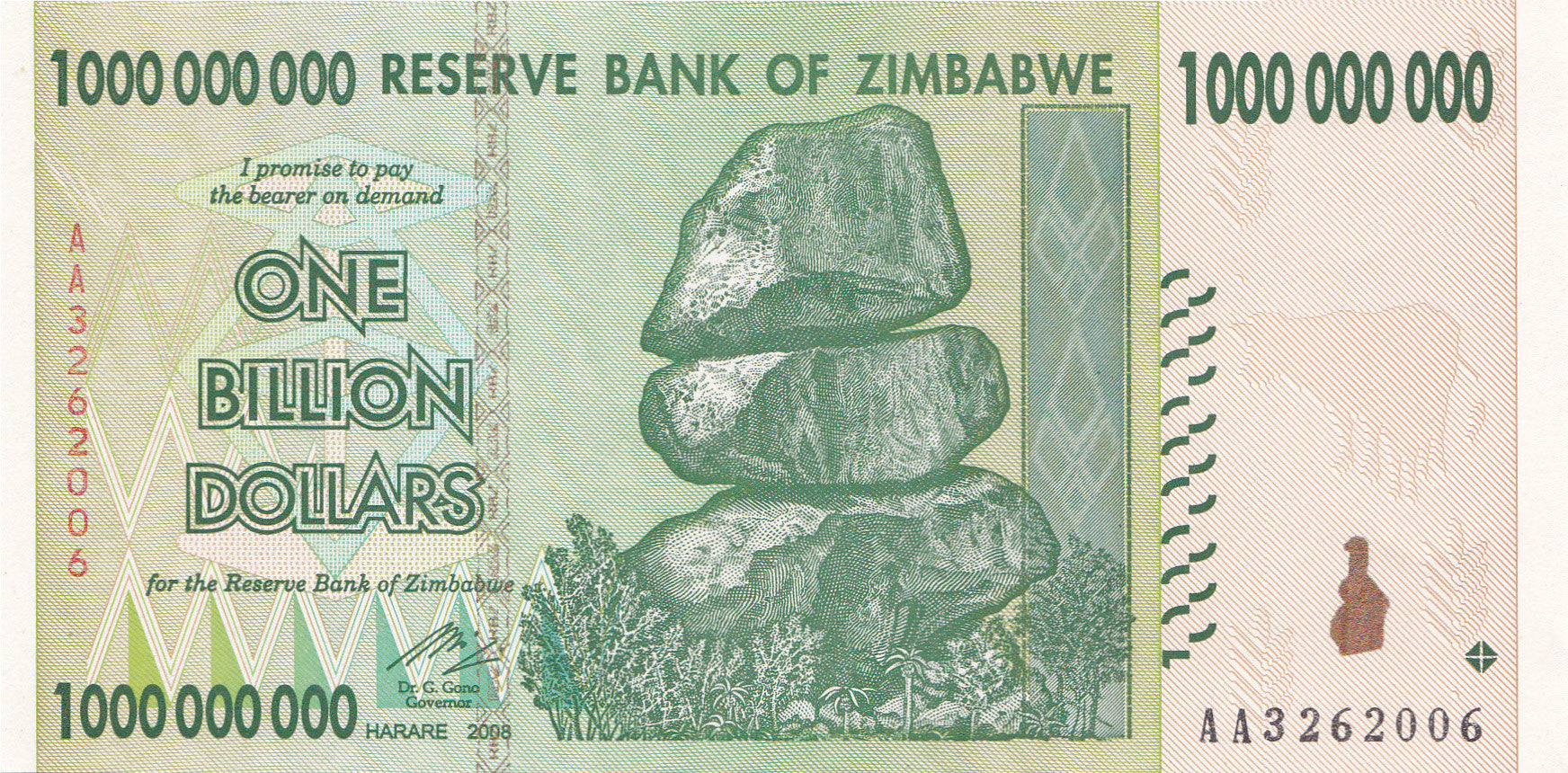

The most notorious example is the hyperinflation experienced by Zimbabwe which resulted in the printing of a one billion dollar note. Today these notes are worthless, other than for use as a novelty and reminder of the potential for hyperinflation when the money supply is not restricted.