NANO is a peer-to-peer digital currency with ultrafast transactions and zero fees, ideally suited for micro transactions. It is a decentralized, open-source cryptocurrency based on directed acyclic graph (DAG) architecture, and released under the FreeBSD License. It operates without intermediaries by utilizing a distributed ledger with a block-lattice data structure.

Market Demand:

The number of Blockchain wallets has been growing since the creation of the Bitcoin. In 2016 there were 9 million wallets, reaching over 54 million Blockchain wallet users at the end of September 2020.

In 2019, E-commerce was responsible for around $3.53 trillion in sales, increasing from $2.92 trillion in 2018. By 2022, the global e-commerce is expected to rise to $5.69 trillion. This represents expected growth of 61% over the next three years. The digital marketplace is growing, and the future belongs to the businesses that can stay ahead of the curve.

We can notice correlation between new crypto users and e-comerce booming. Both merchants and consumers are turning to cryptocurrency payments, as a cheaper and more efficient payment solution. We have already seen major online merchants begin onboarding crypto payments.

High demand and limited scalability have increased the average transaction times and fees in popular cryptocurrencies, yielding an unsatisfactory experience.

Nano was launched with the aim of addressing blockchain scalability limitations that can result in restrictive fees and increased transaction confirmation times under load. It has feeless transactions that typically achieve full confirmation in 0.2–1 second.

The Team

Colin LeMahieu is CEO and Founder of The Nano Foundation. He is executive and software engineer with a background working for the largest technology companies in the industry.

George Coxon the COO of the Nano Foundation and Director of Appia, a decentralised, privacy focused, secure, multi-channel payment infrastructure for cryptocurrencies

Deepa Mardolkar has joined the Nano Foundation as the Chair of the Advisory Board and will help to identify, structure, and scale use cases across the growing community of users, as well as with partner organisations looking for the cutting-edge instant settlement solutions that Nano provides. Having worked for a multitude of leading European and global businesses across retail finance and stored value payments, in multinational organisations such as American Express, GE Money, Capital One, and Amazon, Deepa has set her sights on initiatives that deal with the social side of money.

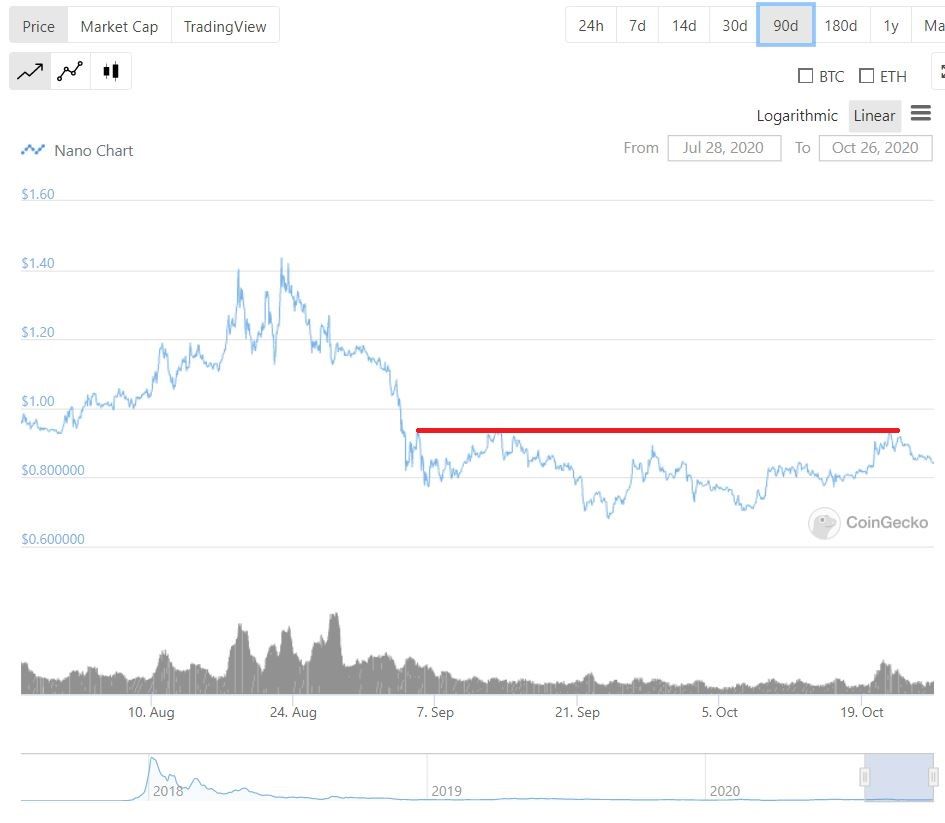

Price Analysis for Nano

NANO has Rank #88 with Market Cap of $ $113 million.

It has a circulating supply of 130 Million coins and a max supply of 133 Million coins (1 BTC = 15268 NANO). All-Time High was $34 almost 3 years ago and is down 97% compared to the current price of $0.852255. All-Time Low was $0.02617900 over 3 years ago and is up 3150% compared to the current price. 24-hour trading volume is $5 million.

Based on the 90-Day chart, there is price consolidation after price diving back in August. Resistance level is $0.93 and if breakout occurs the price will go above $1. Great entry price point is any level below $0.8

Based on the 1-year chart, there is a nice correlation between trading volume and price movement. The last half-year had occurred 2 pumps and dump cycles. Be ready for the third one, if trading volume begins to increase jump the ride.

Kraken is the current most active market trading NANO. It is paired with USD, EUR, and XBT. Other notable exchanges you can find NANO are Binance and Dififinex where it is paired with BTC.

Upcoming Events

- Implement a new work generation algorithm aligned with goals required for usefulness in Nano

- A refactor of the RPC implementation to include removing unnecessary endpoints, providing more consistent responses, expanding the usefulness of responses and errors, and adding new endpoints.

- Move the developer wallet packaged with the node into its own process, separate from the existing node process.

Should I buy Nano?

If mass adoption of cryptocurrencies continues for sure NANO will be in the top 10. Ideally suited for microtransactions, that is what average Joe is looking for in everyday functionality. Also worth mentioning is that Nano is a good investment because it is scarce with no remaining emissions. The most important feature for a non-productive asset is that it is scarce and retains its quality over time.

Should you buy into this cryptocurrency? Investing is a personal choice and investors should consult with experts when making financial decisions. It's important to note cryptocurrencies are highly volatile, unregulated and have the potential to go to zero. If this doesn't discourage you and would like to know if this coin made it to our shortlist, check out our weekly Altcoin Reports.

Read Our Latest Reports...

If you enjoyed this analysis you can read our weekly updates in our Altcoin Report, published every Sunday. In these reports we cover our altcoin findings for the week.

Disclaimer:

The information in this review has been independently sourced and even though we have made the best attempts to report accurately, we do not provide assurances on any of this information. This analysis is provided "as is" and it is up to the reader to do their own due diligence and research. Altcoin Investor is not associated or affiliated with any firm and the opinions are strictly that of the author. This information should not be relied nor is it to be treated as financial advice.