Crypto Staking is a low-risk method for investors to earn passive income on their holdings without needing to sell them.

What is Crypto Staking?

Staking your cryptocurrency offers investors a way to earn passive income without needing to sell them. Staking cryptocurrency can be thought of as similar to earning interest on a high-yield savings account. Staking is a great low-risk method to add additional cryptocurrency to your portfolio, passively.

When you stake your digital assets, you effectively lock up the coins which will be used to participate in blockchain functions, and in exchange, you earn rewards that are calculated in percentage yields.

How Does Staking Work?

Staking is only available on blockchains that are proof-of-work. Proof-of-work is a blockchain mechanism used to verify new blocks of data added to the network.

There are no minimum or maximum limits to be able to stake and generally, you can withdraw your stake at any time (unless you agree to a fixed staking period).

The more you stake, the more you can earn. Any holder can participate in the staking process and it is accomplished by delegating their coins to a stake pool operator which participates in validating transactions on the blockchain.

What Cryptocurrencies Can You Stake?

The list of cryptocurrencies that you are able to stake is increasing, but it is important to note that only proof-of-stake blockchains allow this feature.

Here is a list of the largest cryptocurrencies by market cap which allow staking:

- Ethereum (ETH)

- Cardano (ADA)

- Solana (SOL)

- Avalanche (AVAX)

- Polkadot (DOT)

What are the Risks of Staking Crypto?

Provider, you hold your crypto assets on a cold wallet (like a Trezor or Ledger) the greatest risk to staking cryptocurrency is losing out on the staked earnings. Since your funds are secure in your hardware wallet, there is no risk of loss to your assets, just the staking rewards.

- Some Coins require a minimum 'lockup period' where your funds can not be withdrawn from staking. During this period the coins can not be sold.

- There is a risk that the staking pool operator gets penalized and you may not earn your rewards.

- The staking pool is hacked and the staked funds are stolen.

How Profitable is Staking?

Staking rewards can range anywhere from a few percentages per annum to many hundreds of percentages. Generally, the larger more stable coins offer less staking returns when compared to small projects. However, it's important to beware that small projects also can suffer greater volatility in price.

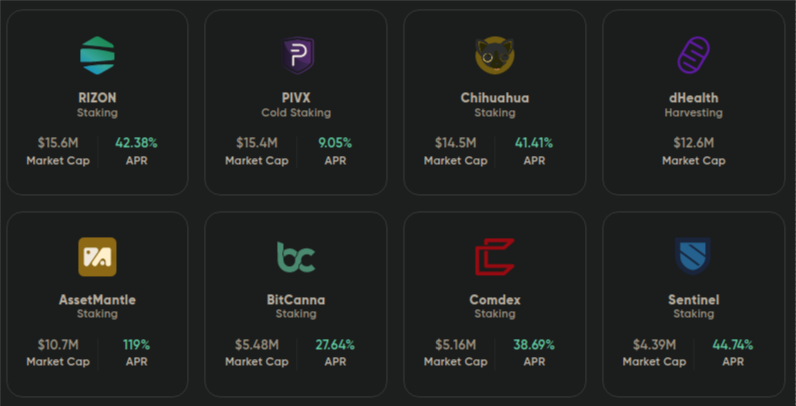

Visiting a site like AllNodes and selecting "Staking" will provide a decent list of the current APRs for each of the coins offering Staking. There are over 40 different coins that offer staking, here is a brief listing:

As you can see from the list above, staking APR can be anywhere from 2% to over 20% for many of the larger cap coins.

Some of the small-cap coins offer even higher staking APRs of up to and over +100% APR. However, with these small-cap coins, it's important to take into account their tendency for high volatility in market price.

How can you start staking

The best and safest method when staking is to be using a hardware wallet like a Trezor or Ledger. Both these wallets already have the functionality to allow for the staking of many coins within their application. However, if you are looking for a wider selection of coins to stake from, the next best method is to connect your hardware wallet to another wallet like Exodus which has a greater selection of staking options, which still have the piece of mind your funds safe in their hardware wallet.

How to Stake from a Trezor Wallet?

Trezor natively supports only a few coins for staking (for example Cardano (ADA)). For a greater selection of coins, connect your Trezor to an Exodus wallet which has a staking interface. Currently, Exodus supports staking for these coins:

- Algorand (ALGO)

- Cardano (ADA)

- Cosmos (ATOM)

- Ontology (ONT) & Ontology Gas (ONG)

- Solana (SOL)

- Tezos (XTZ)

- VeChain (VET) & Vethor (VTHO)

How to Stake from a Ledger Wallet?

The ledger wallet natively supports staking and has a decent selection of coins to choose from.

These include:

- Algorand (ALGO)

- Cosmos (ATOM)

- Tron (TRON)

- Algorand (ALGO)

- Ethereum (ETH)

- Osmosis (OSMOS)

- Polkadot (DOT)

- Tezos (XTZ)