Table of Contents

This overview explains how crypto market making works, and by the end of it, you will know exactly what technical terms like “liquidity”, “spread”, “depth” etc. mean, and have a solid understanding of what market making means.

If you have ever tried to trade cryptocurrencies, you will have noticed that, just like in every other marketplace, there are those who want to buy an asset and those who want to sell it. Ideally, the amount offered and price demanded by the seller and the price the buyer is willing to pay for his desired asset amount are the exact same number. In reality, this is practically never the case. There is always a difference between what buyers and sellers are willing to pay and receive. This discrepancy between the offered versus asked price is what is called the “spread”. Without enough buyers, the sellers cannot sell, and vice versa. And that is where market makers come into play.

Crypto market making involves a company (or individual) continuously buying and selling a particular token/coin on an exchange, thereby providing liquidity and reducing price volatility. The crypto market maker, quotes both a buy (“bid”) and a sell price “(ask”) for a particular cryptocurrency and aims to profit from the spread between the bid and the ask prices. Whenever there aren’t enough buyers/sellers in any given market, it causes a lack of “liquidity”. Liquidity refers to how easily an asset can be bought or sold at any given moment (which is 24/7 in crypto!) without causing a huge price impact. Providing liquidity, as in buy and sell support, is exactly what a market maker does, which is why they’re also sometimes called “liquidity providers”.

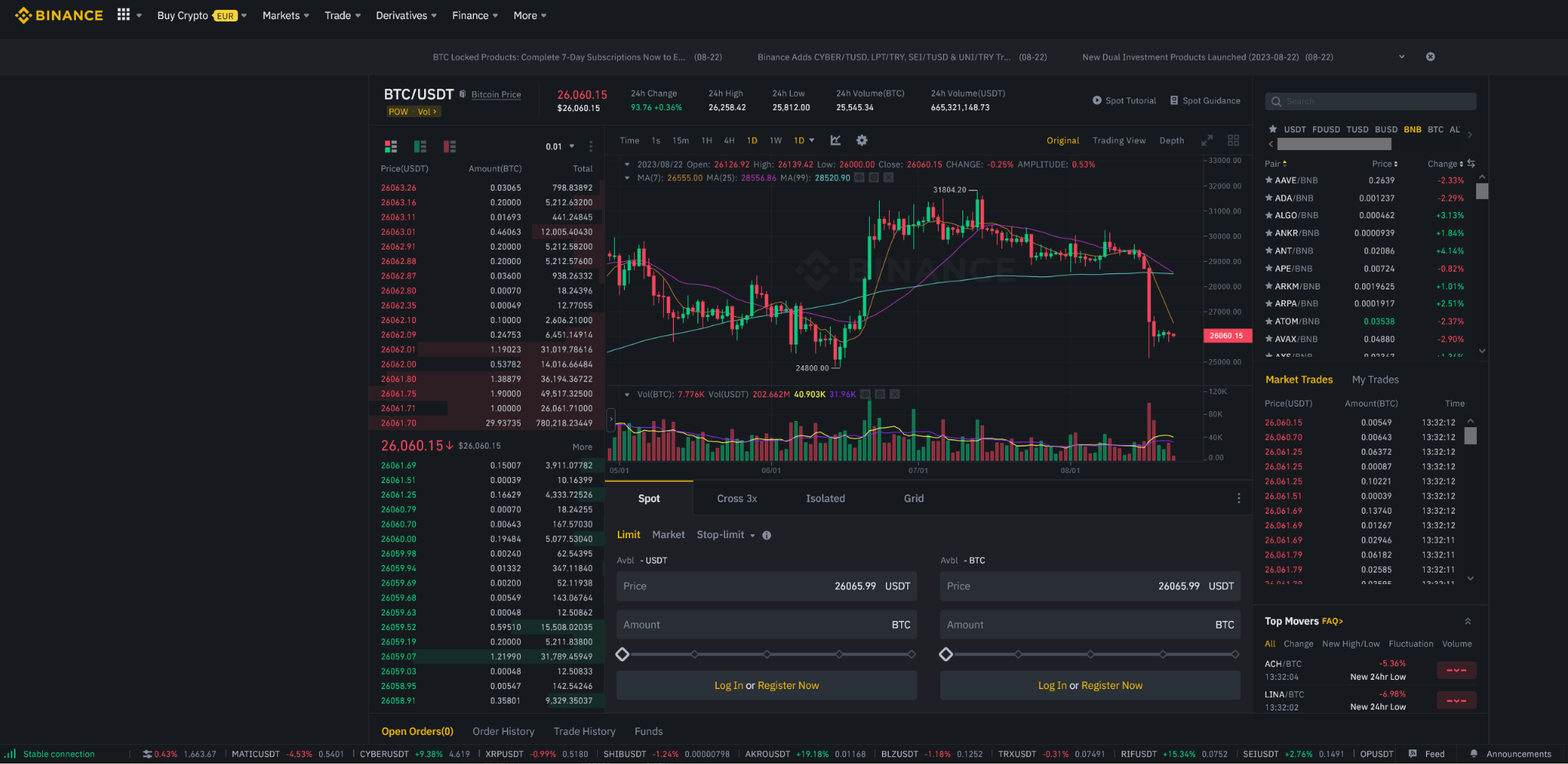

Another important term you’ll come across is “order book depth”. At any given particular time there is always a certain number of price levels evident in the order book. You’ve certainly seen this before - exchanges usually display order book depth in their interface, in the form of red and green charts and price numbers for the bids and asks.

Market making in crypto

Market making is not only used in the cryptocurrency space. In fact, it has been a commonly used practice in traditional finance, e.g. Wall Street, for decades. The concept itself, therefore, is not new. The way in which it is done, however, differs in some ways from the TradFi space, especially with the rise of DeFi.

We’ve already established that a sustainable market needs a constant supply of buyers and

sellers. However, this does not always mean actual individuals manually buying or selling a token. Nowadays, on stock and crypto exchanges alike, automated trading is used to send

orders and make trades, faster than any human could, it is therefore also called “high-frequency trading”. Automated and specially programmed computer code, often referred to as “trading bots” is used to execute these big and frequent orders according to a predetermined strategy. The strategies are initially thought up and developed by humans, but the execution happens automatically by the program. With the rise of artificial intelligence and fast data processing methods and infrastructure, these bots and algorithms become increasingly smarter and more complex. They can even “learn” from a given input, such as historical data or other variables, etc., to increase their efficiency even more and “by themselves”. This is what is also called “machine learning”, and is a tremendously promising field of research that’s already being put into practice.

Why is crypto market making so important for tokens?

Generally speaking, professional market makers can help to create and sustain healthy and

stable market conditions where a steady flow of buying and trading is possible. They do this by providing liquidity and using specific trading strategies and smart techniques to make the best out of any given market situation, stabilizing the crypto economy and reducing much-feared high volatility. Without crypto market makers intervening, markets would be much less stable and efficient and it would be increasingly harder for buyers and sellers to execute trades at their desired price levels. It is for that reason, that many exchanges even work with dedicated market makers (many even demand certain metrics to be met), and token projects interested in long-term success and sound price discovery work with market makers as well. Market making has become as common and important in crypto nowadays as it is in TradFi. Although, one should mention that crypto market making methods do differ fundamentally between centralized and decentralized exchanges, due to the structural differences in how these exchanges are operated and set up.

CEX vs. DEX - How trading on decentralized exchanges differs from centralized ones

Crypto market making and centralized exchanges

Most reputable centralized exchanges and token projects know how essential sufficient liquidity is for their assets and their businesses as a whole. This is why they rely heavily on professional market makers to help them provide liquidity for their assets. Centralized exchanges are actual companies run as a business, including people who run it, i.e. it is not peer-to-peer, it’s b2c/b2b. A CEX operates on “classic” order books, much like in TradFi. These order books are basically lists of orders from potential buyers (bids) and sellers (asks) and orders get filled based on an order matching system to find a well-matched price. However, this largely depends on the depth (price level number) of the order book and the liquidity provided for a given asset. The difference between bid and ask prices for an asset is what is referred to as the spread. The bid-ask spread is the gap between the highest bid and lowest ask. Market makers use smart technology (including computer code/algorithms) and sophisticated strategies to leverage this spread to their advantage or achieve a desired outcome. They provide the markets with much-needed liquidity, to create a more stable and less volatile market environment, and profit from this provision.

Crypto market making and decentralized exchanges

Decentralized exchanges principally rely on distributed governance among the people who use them. They are meant to be used in a trustless way, which means no interpersonal trust is required because everything is checked and executed through computer code using algorithms, smart contracts, and the like. However, this also means that there’s usually not a classic order book to be found. The way trades are facilitated varies from DEX to DEX. DEXs are peer-to-peer exchanges, i.e. there is no middleman or institution involved in the trades as they happen directly between two parties without the need for external custody of funds, directly between two wallet-holders (traders). The way this works is by leveraging the power of so-called smart contracts, which are pieces of blockchain code that automatically get triggered when certain predetermined criteria are met and execute the programmed functions accordingly. This process is thereby fully automated. Much like centralized exchanges, which can chargetaker fees/maker fees, as well as withdrawal fees, due to their decentralized nature, DEXs also charge transaction fees. These fees can often become an issue, especially if they become too high to make frequent trades profitable, for instance, if margins made by trading (for example when arbitraging between DEXs) are eaten up by high trading fees (e.g. gas fees on Ethereum).

Different types of market making on DEXs have emerged and new ones keep being tested.

Some of the most popular include AMM (automated market makers using smart contracts and oracles, as is used by DEX giant Uniswap), aggregators (combining different methods), and order book-based ones, which operate similarly to CEXs. With the growing number of DEXs available, one way to leverage market makers is to ask for algorithmic arbitrage strategies or similar advanced ways to leverage the DEX variance. Unfortunately, most DEXs still struggle greatly with sufficient liquidity provision. On top of that, DEXs face issues such as difficulty tightening the spreads, solid liquidity requiring a lot of capital committed to the pools, as well as slippage and impermanent loss.

How does a crypto market maker make money?

Let’s now highlight the economic side of things a bit more. By now it should be evident that market making is a necessary and essential part of a healthy market. Yet you might still ask yourself: “What’s the business model of a market maker?”. It was already previously mentioned that market makers can profit off of the spread between bids and asks. In fact, this is a significant income stream for most market makers, although the profit levels largely depend on overall market conditions, fees (think maker and taker fees), the depth and liquidity of the specific markets, as well as the skill and strategies of the market makers, especially when it comes to risk management. Depending on the company behind it, market makers have differing business models and most have some sort of special field of expertise or additional services they offer to distinguish themselves.

Crypto market-maker-driven vs. client-driven model

There are two different kinds of market-making concepts in general:

I) Market maker/Liquidity driven

In this traditional model, the ones who provide liquidity using their own funds to trade and

(ideally) profit from the PnL (profit and loss) made, generated by the spread (for example

companies like Wintermute). This market-maker incentivizing solution can provide a significant amount of liquidity in a short time frame. In this scenario, of course, the one aiming to profit from the committed funds and using strategies accordingly is the market maker. Most market makers at this point in time, opt for this market-making as-a-business model. This approach is used by big firms and funds, who leverage their own capital to trade, such as industry giants like Cumberland or GSR.

II) Client/Strategy driven

This model refers to market makers that provide their clients with sophisticated algorithmic trading software services to ensure all trades are executed in the client’s interests, following their custom strategies and goals. This means the client’s own funds are leveraged to trade and make the markets, using complex individual strategies that align with the client’s incentives. In this case, PnL stays with the client, and trading activities are best aligned with the client-company goals (for example crypto market-making companies like Autowhale). This crypto market-making as-a-service model requires a client to commit their own funds for liquidity but maximizes control over the trading strategies, profits and losses stay with the client, and trading goals are aligned with the client’s vision. Oftentimes, these service-based firms also offer varying other services, such as customized solutions, facilitation of exchange listings, consulting, etc. This approach is used by client-oriented companies whose goal is to create a thriving market for crypto projects, such as crypto market maker Autowhale. Autowhale enables funds, trading desks, and token projects to launch any form of trading and investment strategy at scale with their proprietary trading infrastructure, embedded in a securely cloud-hosted, all-in-one trading system.

In conclusion, crypto market making can be profitable if someone knows what they’re doing and it is a vital part of a healthy crypto economy and stable crypto markets overall. Understanding which role market makers play in this field, knowing they’re an omnipresent part of crypto, and getting the jist of how it all works should give you more insight into how the crypto trading space operates on the micro and macro levels. For token projects, professional crypto market making is a state-of-the-art tool to reach their long-term goals and keep their communities content and markets thriving.

Sophie Weidenhiller

COO at Autowhale

About US: Autowhale enables funds, trading desks, and token projects to launch any form of trading and investment strategy at scale embedded in a securely cloud-hosted all-in-one trading system with their proprietary trading infrastructure.