When it comes to investing it’s important to have a sense of where the markets are going. While none of us have a crystal ball to accurately predict the price movements of Bitcoin, we can take guidance from the historical price movement. Interestingly, based on the historical price action of Bitcoin, there is some very compelling data on the likely 2022 year-end price for Bitcoin.

Looking Back on History

While the historical price action of Bitcoin is not a predictor for the future price movements of Bitcoin, there is an interesting trend that, if continues to hold true for 2022, will offer an idea as to where the price of Bitcoin will be at the end of the year.

An Interesting Anomaly

There is an interesting anomaly we have seen in the price of Bitcoin over the last 13 years.

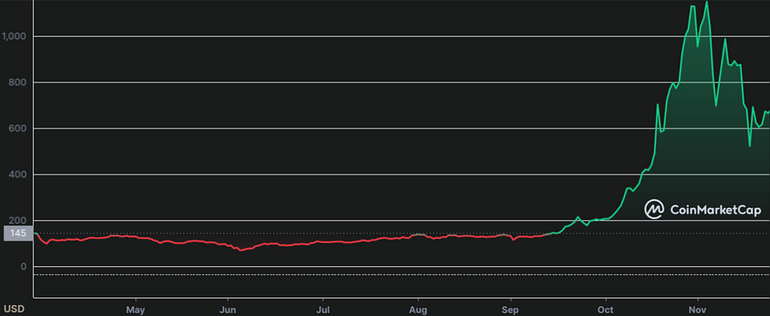

In a Bull market, the price of Bitcoin peaks at the end of the calender year.

Let’s take a look at some examples of this strange anomaly…

In 2013, the Price of Bitcoin hit its all-time high on December 3rd.

In 2015, the Price of Bitcoin hit its all-time high on December 12th.

In 2016, the Price of Bitcoin hit its all-time high on January 3rd

In 2017, the Price of Bitcoin hit its all-time high on December 15th

In 2020, the Price of Bitcoin hit its all-time high on January 7th

In these examples, the price of Bitcoin hit its all-time high right at the end of the year (during a bull market).

However, what happens during a bear market?

Interestingly, we see the same exact price action play out, just in reverse.

In a Bear market, the price of Bitcoin hits its low at the end of the calender year.

Bitcoin Price Action in a Bear Market

In a bear market, we see the exact opposite occurring with the lowest price occurring at the end of the year.

In 2014, the Price of Bitcoin hit its all-time low on January 13th

In 2018, the Price of Bitcoin hit its all-time low on December 15th

In 2022, we see a similar pattern occurring…

While this trend in Bitcoin price does seem very compelling, it's necessary to note that there are two years where this phenomenon did not occur, in 2021 (where we saw the all-time high of Bitcoin) and 2019.

End of the Year Price Prediction for Bitcoin (2022)

This end-of-year price prediction is solely based on the prior year trends as mentioned above. While this data is compelling, it isn’t comprehensive yet does offer a sense of the future market movement.

Of course, when performing any type of analysis, it’s important to take into account many different indicators. Such indicators can include taking into account the Bitcoin Halving Cycle, current and historical fear and greed index, Bitcoin Rainbow Chart, and current and future economic events well as various technical indicators.

However, for the scope of this article, I am only looking at past historical price movements and the trend we see towards the end of the year.

If this trend holds true, and as we are currently in a bear market, it’s likely we will see Bitcoin hit its all-time low (for the year) price at the end of the year. This will be a price below $20,000 and could range anywhere between $10k-20k.

Brief History of the Bitcoin Bull & Bear Markets

If you would like a more comprehensive and detailed analysis of the bull and bear markets for Bitcoin from 2008–2022, Please read The Brief History of Bitcoin Bull & Bear Markets.

Learn to Profitably Invest in Low-Cap Gems

Some of the best returns ever seen within the cryptocurrency market have come from low-cap gems. In the beginning, there was only Bitcoin and if you purchased it when it was only a few dollars, this could have been considered a low-cap gem. While the opportunity to purchase Bitcoin for only a few dollars no longer exists, there is a thriving cryptocurrency market of over 10,000 actively traded cryptocurrencies - some of these are diamonds in the rough, also known as low-cap gems.

Follow us as we explore the cryptocurrency market in search of the next low-cap gem.

Signup for our FREE Newsletter

If you would like to learn more about the cryptocurrency space and new opportunities within this space such as low-cap gems (+100x returns), subscribe to our free newsletter below to learn more.