Table of Contents

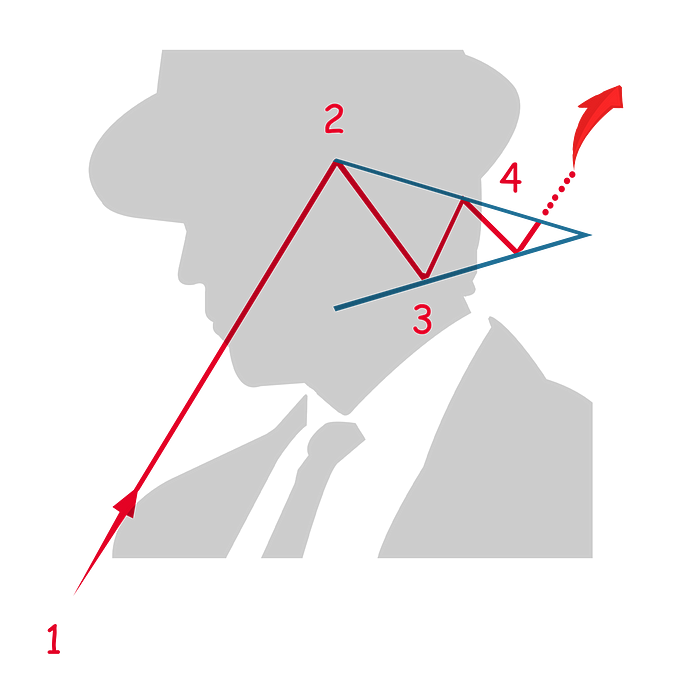

The "bullish pennant" pattern is a favorite among traders for signaling a continuation of an existing uptrend. It is very similar to the bullish flag pattern but features a symmetrical triangular shape instead of a rectangular flag. This pattern typically forms during a brief consolidation period after a strong upward move and is followed by a continuation of the uptrend.

Here’s how it's structured and how traders interpret and use it:

Structure

1. The Pole: The pole is created by a significant, sharp increase in the price of the asset, indicating a strong bullish momentum. This initial surge should occur on high volume, reflecting strong buyer interest.

2. The Pennant: After the pole, the price starts to consolidate and forms a symmetrical triangle where both the support and resistance lines converge. This consolidation usually involves a decrease in volume and represents a period where buyers and sellers are pausing. The swings within the pennant become smaller and less volatile as the lines converge.

Significance

The bullish pennant pattern is considered a continuation pattern, suggesting that after the consolidation phase, the bullish trend is likely to resume. The pattern indicates that despite the pause, the buying pressure still underpins the asset's price, and traders are consolidating gains before pushing the price higher again.

Trading Considerations

- Entry Point: Traders often look for an entry point when the price breaks out of the pennant on the upside. This breakout should ideally occur on a higher volume to confirm the pattern’s validity and the likely continuation of the uptrend.

- Target Price: The target price after the breakout can be estimated by measuring the length of the pole and projecting that distance upward from the breakout point at the pennant.

- Stop Loss: To manage risk, a stop-loss is commonly placed below the lowest point within the pennant or at a predetermined percentage below the breakout level.

- Volume: Monitoring volume is crucial; it should be high during the pole's formation and lower during the consolidation. An increase in volume on the breakout supports the continuation of the uptrend.

The bullish pennant pattern is highly regarded for its reliability and the relatively clear signals it provides for the continuation of an uptrend. However, like all trading strategies, it is most effective when used in conjunction with other indicators and analysis methods to confirm trends and manage risks effectively.