CBDCs are digital currencies issued by a central bank and are pegged to the value of that country's fiat currency.

A CBDC is a new type of central bank currency that harnesses the power of the blockchain.

CBDC is an acronym for “Central Bank Digital Currency,” a new type of currency that governments around the world are experimenting with. What makes a CBDC different than traditional fiat currency is that it uses the blockchain, to potentially increase payment efficiency, lower costs and improve transparency.

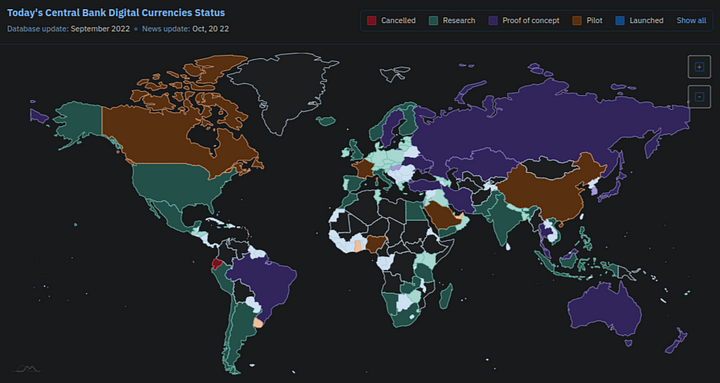

How many countries are experimenting with CBDCs?

According to CBDC Tracker, almost all countries in the world are experimenting with CBDCs and are in various phases of development and implementation.

Central Bank Digital Currencies Launched

As of March 2022, there were nine countries and territories that had launched CBDCs which include:

- The Bahamas

- Antigua and Barbuda

- St. Kitts and Nevis

- Monserrat

- Dominica

- Saint Lucia

- St. Vincent and the Grenadines

- Grenada

- Nigeria

There are also +80 other countries with CBDC initiatives and projects underway.

How do Central Bank Digital Currencies Work?

Central Bank Digital Currencies (CBDCs) represent a digital form of a country's fiat currency, issued and regulated by the nation's central bank.

They aim to modernize the financial system by integrating the benefits of digital currencies while maintaining the stability and security traditionally associated with government-backed money.

Here's how CBDCs generally work:

Issuance and Regulation

- The central bank of a country issues the CBDC, directly controlling its supply and ensuring its stability. Unlike cryptocurrencies such as Bitcoin, which are decentralized and have no central authority, CBDCs are centralized and regulated by the issuing authority.

Digital Form

- CBDCs exist in a digital form, meaning they are electronic representations of money. They can be used for digital transactions, including payments and transfers, without the need for physical cash.

Technology Platform

- While not all CBDCs use blockchain technology, some may leverage it or similar distributed ledger technologies (DLT) for security, transparency, and efficiency in transactions. These technologies can provide a decentralized network for transaction validation, although the final authority remains with the central bank.

Two Types of CBDCs

- Wholesale CBDCs: Intended for financial institutions that hold reserve deposits with a central bank. They can be used for interbank payments and financial settlements.

- Retail CBDCs: Available to the general public for daily transactions and payments. They aim to provide an accessible, efficient, and secure digital payment method for individuals and businesses.

Implementation and Use

- Users may access CBDCs through digital wallets or electronic devices, enabling them to make transactions online or in person. The central bank or authorized financial institutions may provide these digital wallets.

- Transactions with CBDCs can be designed to be faster, cheaper, and more secure compared to traditional banking transactions or even some digital payment methods.

Privacy and Security

- CBDCs are designed with a focus on privacy and security, though the exact approach can vary by country. Some systems may offer anonymity for small transactions, while others might require identity verification to prevent fraud and money laundering.

Monetary Policy and Financial Stability

- CBDCs give central banks a new tool for implementing monetary policy. By directly influencing the digital currency's circulation, central banks can more effectively manage economic factors like inflation and interest rates.

- They also aim to enhance financial stability by providing a secure and efficient payment system that complements traditional banking systems.

International Transactions

- CBDCs could simplify cross-border payments, making them faster and less expensive by reducing the need for intermediaries and currency exchange.

Challenges and Considerations

- The implementation of CBDCs involves significant challenges, including privacy concerns, cybersecurity risks, and the potential impact on the traditional banking sector.

- Central banks must also consider the technological infrastructure required to support CBDCs and ensure that it is accessible to all segments of the population.

What are the Dangers of CBDCs?

There are many dangers individuals, corporations and government bodies should be aware of when it comes to implementing CBDCs including privacy concerns, as they could enable unprecedented surveillance of individuals' financial transactions by governments.

There's also a risk of centralizing power, potentially leading to financial exclusion for those not participating in the digital economy. Additionally, there's the threat of cyber-attacks and technical failures, which could compromise the security and integrity of a nation's financial system.

For a full breakdown of the dangers of Central Bank Digitial currencies, check out this article

Summary

In summary, CBDCs represent an evolution in the digitization of money, aiming to harness the advantages of digital currency technology under the regulated oversight of central banks. Their development and deployment are closely watched worldwide, as they hold the potential to reshape the global financial landscape.

You May Also Like: