Table of Contents

Dogecoin Price Above $10: Could This Be the Bull Cycle That Makes Millionaires?

A Market Buzz Like No Other

The cryptocurrency market is alive with chatter as Dogecoin (DOGE)—the internet’s beloved meme coin—continues capturing headlines. As speculations grow about DOGE potentially surpassing $10 in this bull market, investors are starting to pay closer attention. Whether you’re an experienced trader or new to crypto, it’s time to explore what might drive Dogecoin’s price and how you can position yourself to profit.

Dogecoin’s Journey: From Meme to Serious Contender

Launched in 2013 as a joke inspired by a viral meme, Dogecoin quickly carved out a unique identity within the crypto space. Fast forward to 2021, and this “joke” evolved into a sensation that saw DOGE’s value skyrocket to $0.73, thanks in no small part to enthusiasm from figures like Tesla’s Elon Musk.

Over the years, Dogecoin has weathered multiple bull and bear cycles, each shaping its narrative. But what’s different about this market cycle? The answer lies in new developments, retail adoption, and increasing use cases that are giving the coin staying power and real upside potential.

Will Dogecoin Hit $10 in This Bull Cycle?

Historical Trends Shed Light

To understand if $10 is achievable, it’s important to consider how Dogecoin has performed in prior bull markets. Compared to major coins like Bitcoin and Ethereum, DOGE often leaps higher due to its strong community and meme status. However, its circulating supply—over 10 billion—requires substantial capital influx to push prices to double digits.

Key Drivers Behind the $10 Goal

So, what could fuel Dogecoin’s ascent? A few factors are worth noting:

- Massive social media-driven retail adoption, bolstered by influencers and viral campaigns.

- Growing institutional interest in meme coins, previously seen primarily as speculative assets.

- The timing of altcoin season, which historically follows Bitcoin’s rallies and benefits tokens like DOGE.

- Increased adoption for real-world use cases through partnerships and applications.

Catalysts Lifting Dogecoin’s Price Higher

Potential Integration into X (formerly Twitter)

Elon Musk’s acquisition of Twitter (rebranded to X) has reignited speculation about Dogecoin’s future. Could it be used for tipping, ads, or payments on the platform? While nothing is confirmed, the possibility keeps excitement levels high.

Wider Payment Platform Adoption

Platforms like Robinhood and PayPal have already integrated Dogecoin, making it more accessible to millions of users. This attention from mainstream services enhances DOGE's usability and attracts new investors.

The Meme Coin Phenomenon

Dogecoin faces competition from projects like Shiba Inu and PepeCoin, but its first-mover advantage and recognition as the originator of meme coins give it an edge in the battle for investor loyalty.

Ways to Profit from Dogecoin’s Bull Market

Whether you’re a long-term believer or looking for short-term gains, here are some strategies to make the most of this bull cycle:

Invest at Optimal Times

Using a dollar-cost averaging (DCA) approach can help reduce the risks associated with volatile price swings. Additionally, keep an eye on corrections—a common occurrence during rallies—to identify potential buying opportunities.

Take Advantage of Trading Volatility

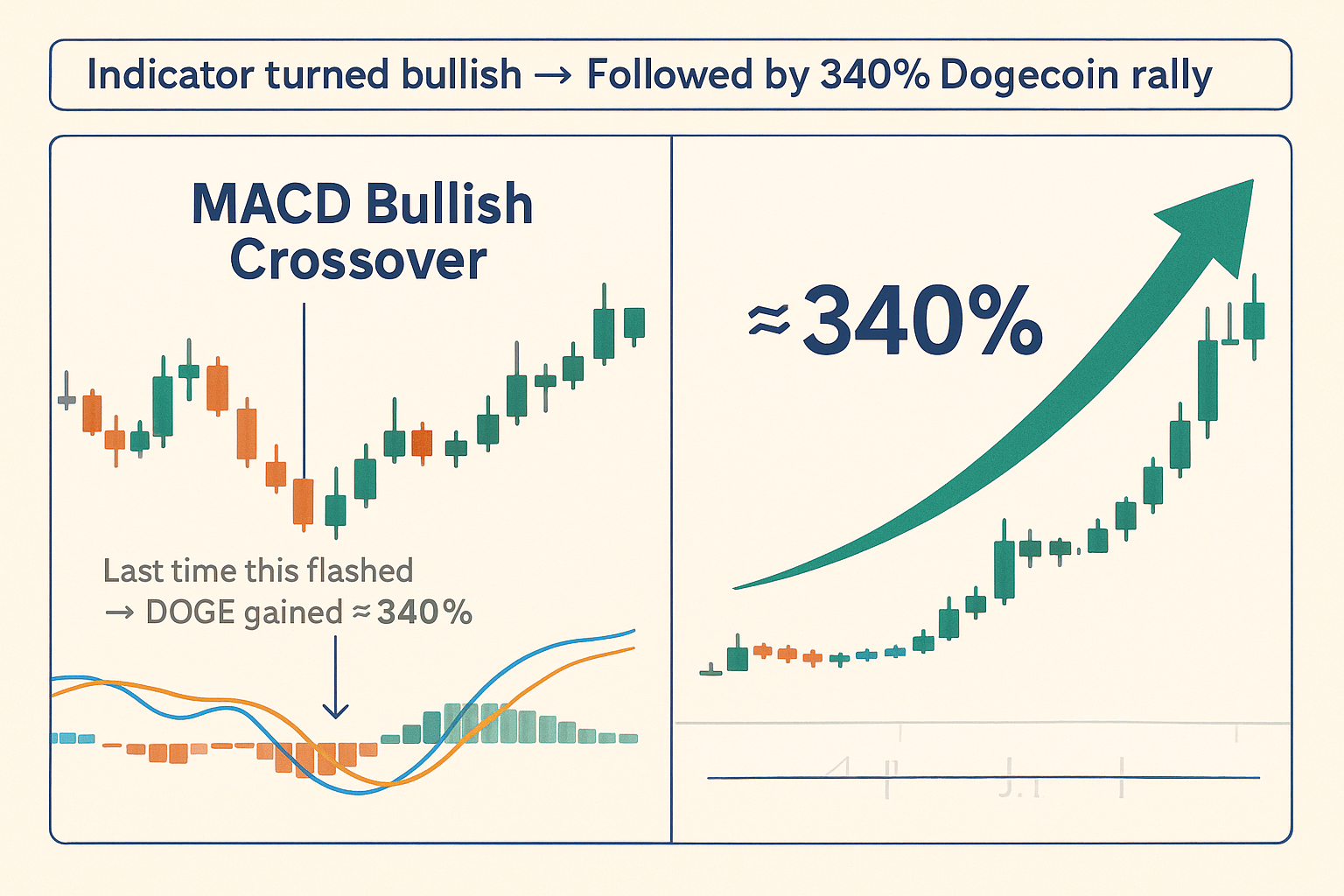

Active traders can leverage market volatility through swing trading. By analyzing technical indicators like RSI or MACD, it’s possible to time your entries and exits more effectively.

Consider Staking or Long-Term Holding

If you believe in Dogecoin’s long-term potential, holding through market fluctuations or exploring staking options may yield better gains than short-term trading efforts.

Diversify Your Portfolio

Don’t put all your eggs in one basket. Allocating some assets to related meme coins or high-performing altcoins can help balance your risk exposure.

Recognizing the Risks

Inflation and Infinite Supply

Dogecoin’s infinite token supply is often criticized for potentially limiting long-term price growth. Inflation continues to dilute its value over time, making price sustainability a challenge.

Volatility and Speculation

Meme coins like Dogecoin are heavily reliant on hype, which can lead to drastic price swings. Be cautious of FOMO (Fear of Missing Out) and speculative euphoria.

Regulatory Concerns

Global regulations targeting cryptocurrencies could hinder adoption and slow momentum across the market. Staying informed about these developments is crucial for managing risk.

What’s the Bull Cycle Peak for Dogecoin?

Many analysts predict Dogecoin’s price could safely land in the $1-$5 range, but the elusive $10 mark represents a far more ambitious target. Breakthrough events—such as viral hype, significant partnerships, or regulatory clarity—could be pivotal in pushing DOGE to new heights.

Practical Tips for Navigating This Bull Market

To maximize profit potential while managing risks, keep these tips in mind:

- Define clear investment goals: Decide if you’re targeting short-term profits or long-term growth.

- Stay updated on major news: Follow key developments, especially those involving Elon Musk or financial partnerships.

- Limit emotional decisions: Overconfidence can lead to poor judgment—stick to your strategy.

- Be disciplined about profit-taking: Secure gains when the market gives you opportunities.

Wrapping It All Up: Could Dogecoin’s Journey Reach $10?

Dogecoin remains one of the most polarizing assets in the cryptocurrency landscape. Its quirky origin persistently defies expectations, and this bull market could see it reach unprecedented levels. However, keep in mind that speculation often fuels its meteoric rises—so while $10 is possible, it’s far from guaranteed.

Approach this opportunity with a combination of optimism and careful planning, whether you’re a seasoned crypto trader or just beginning your trading adventure. Remember, cryptocurrency investing is as much about risk management as it is about chasing returns.

Disclaimer: This content is for informational purposes only and should not be considered financial advice. Cryptocurrency investments carry significant risk. Always conduct your own research before making financial decisions.