Blockchain technology is ushering in a new form of currency and central banks are taking advantage of this.

Central Banks around the world are in the process of creating and implementing a new type of digital currency — Central Bank Digital Currency (CBDCs).

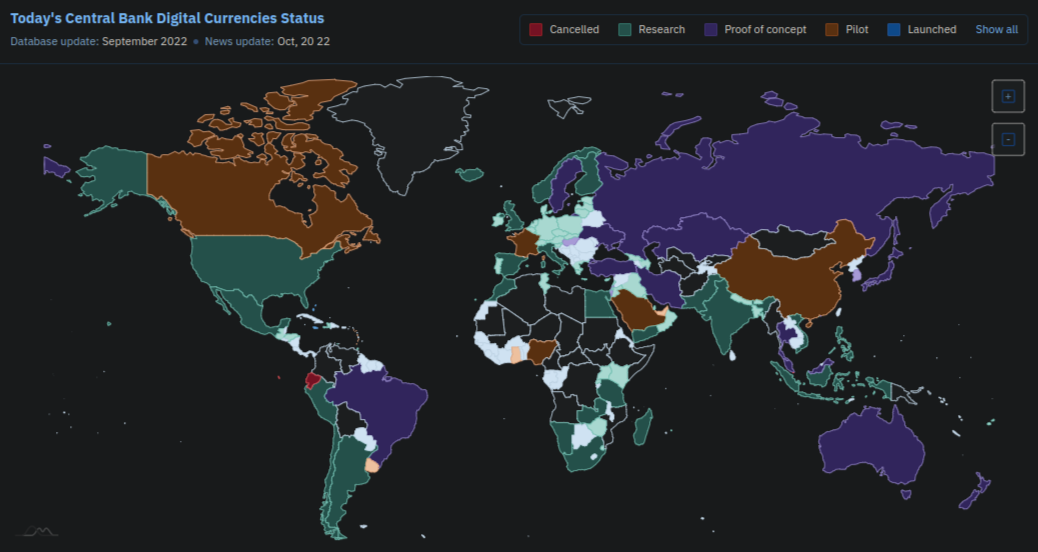

CBDCs are Worldwide

According to CBDC Tracker, almost all countries of the world (with Central Banks) are experimenting with CBDCs and are in various phases of development and implementation.

There are nine countries and territories that have already launched their CBDCs which include:

- The Bahamas

- Antigua and Barbuda

- St. Kitts and Nevis

- Monserrat

- Dominica

- Saint Lucia

- St. Vincent and the Grenadines

- Grenada

- Nigeria

There are also a number of countries (the list is growing) with active pilot programs. There are also +80 other countries with CBDC initiatives and projects underway.

What is a Central Bank Digital Currency?

A Central Bank Digital Currency is an equivalent to digital cash, issued by a central bank and pegged to the value of the country's fiat currency.

Privacy Concerns of CBDCs

However, unlike physical cash, which has the ability to be transacted anonymously, digital cash is not anonymous and can be programmed.

It is the programmability of digital cash which is of greatest concern.

The programmability of digital cash gives the power to (central) banks direct insight into purchases and the identities of the transacting parties as well as the ability to block or censor any transaction.

This new form of ‘digital cash’ may pose the single greatest threat to personal liberty and freedom in our lifetime.

Concerns of Programmable Digital Money

Due to the technological nature of ‘digital money’, much more control over its usage can be made when compared to traditional cash.

This is a new type of money that has many ‘features’ that have not been previously possible with traditional money.

CBDCs give the ability for (central) banks to block, censor, incentivize or discourage any type of transaction.

This can include:

- Capping Cash Balances

Banks have the ability to disincentive saving money by putting a cap on cash balances and then charging a negative interest rate on balances over the cap. While this may sound like science fiction, it is already in place in the Bahamas CBDC, (The Sand dollar).

- Specific Use Only

CBDCs could be programmed to only be spendable at certain retailers, during specific periods, and/or only spendable by specific individuals.

- Negative Interest Rates

While it is common to expect a positive interest rate in your bank account, CBDCs can be programmed to include negative interest rates as a form of disincentive.

- Expiry Dates

Unlike traditional money, CBDCs could be programmed to expire after a specific date, in this way creating an incentive to spend it before it expires.

- Taxation per transaction

Mandatory taxation could be imposed on every CBDC transaction as a form of tax revenue for the state and could be imposed on all and every transaction.

The term ‘digital cash’ doesn’t fully encompass the possibilities available to (central) banks when they have the power to program money, effectively transforming this ‘digital money’ into a state-issued token, which then would only be able to be spent under their predefined conditions.

How Dangerous are CBDCs?

Central Bank Digital Currencies are a tool with the power to effectively turn digital money into a state-issued token.

CBDCs are set to be implemented across the world in each and every country that has an existing central bank.

This new form of digital money gives (central) banks a level of transactional granularity and control over the use of money which has never existed before.

While they may tout the benefits of digital money to help control the money supply and reduce illegal or illicit transactions, the freedom we once had to anonymously spend cash would be non-existent with this digital money.

Our ability to spend this ‘digital money’ would be at the discretion of the governing body and the level of programming embedded in the money.

November of this year is set to be the beginning of the ISO 20022 standard (Update: Postponed to March 2023), a standard that will be used by central banks and financial institutions in the cross-border and international money movement and a key component of this new financial system.

While CBDCs have been touted as a means to fight fraud and enable greater financial stability, they also have the (likely) potential to be abused.

CBDCs have the potential to become the greatest single threat to personal liberty and freedom in our lifetime.

While it is likely we can do little to prevent the adoption and implementation of CBDCs by banks and world governments, as individuals we do have the power to educate ourselves and be well-prepared for this new global financial system.

CBDCs, the implementation of ISO20022, and the move toward a cashless society is part of a much larger agenda, referred to as the New Quantum Financial System (QFS).

What is the New Quantum Financial System?

The New Quantum Financial System (QFS) is a term that has been gaining popularity in various online forums, articles, and discussions, often in the context of financial technology and sometimes in relation to cryptocurrencies or global economic changes. It is the new global financial system the entire world is moving towards, which uses a mix of blockchain technology and quantum computing to usher in a new global financial system.

To learn more about this new global financial system, read:

You May Also Be Interested In: