Table of Contents

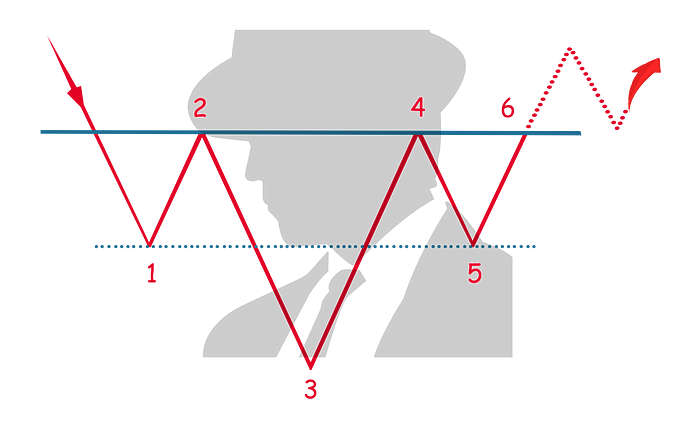

The "head and shoulders inverted" (or "reverse head and shoulders") pattern is a bullish chart formation that often signals a potential reversal of a downtrend.

Here's how you can understand and spot it:

Structure

This pattern is essentially the mirror image of the classic head and shoulders pattern, but it occurs after a downward trend. It consists of three troughs:

- Left Shoulder: After an ongoing downtrend, the price makes a new low and then rises again to a certain point.

- Head: The price drops again, making a lower low than the left shoulder, and rises once more.

- Right Shoulder: The price makes a third low, but this time it's higher than the head's low, before rising again.

The highs of the recovery after each trough typically reach around the same level, forming what's called the "neckline."

Significance

When the price rises and breaks through this neckline, it's considered a confirmation of the pattern and a signal that the downtrend might be reversing. Traders often see this as an opportunity to buy.

Trading Considerations

- Volume: Ideally, the volume should confirm the pattern. Volume should be higher on the upward moves and lower during the declines. A volume spike on the neckline breakout is a strong buy signal.

- Target Price: After the breakout, traders often estimate the potential rise by measuring the vertical distance from the head's lowest point to the neckline and then projecting that same distance upward from the neckline.

- Pullbacks: After the initial breakout, the price might test the neckline again from above as new support. This pullback can offer a secondary buying opportunity.

The head and shoulders reversal is popular among traders because of its relative reliability and clear setup. However, as with all trading patterns, it's wise to use it in conjunction with other technical indicators and analyses to validate the signal.