Table of Contents

Crypto analytics platform, Glassnode, reveals that Bitcoin's performance in the first half of this year has not only piqued the interest of individual investors but also attracted institutional investors looking for larger investment opportunities.

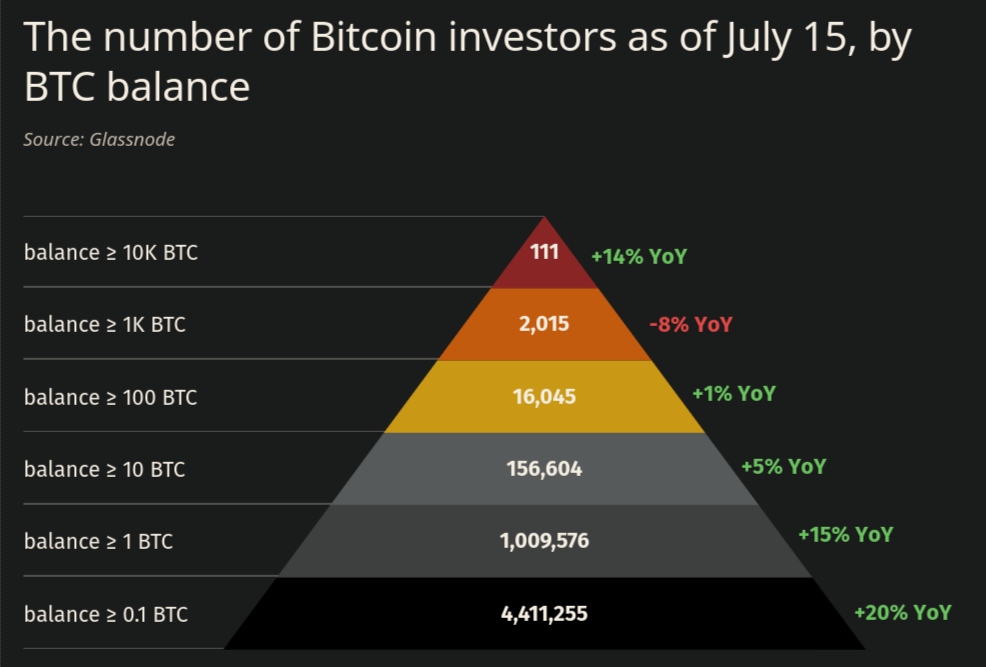

As of last week, the number of wallets containing at least 1 BTC, valued at approximately $30,300, reached an all-time high. Data reveals that the count of such investors escalated by 133,000 or 15% from the previous year, hitting an all-time peak of 1.09 million on July 15.

Information from Glassnode indicates that there are 156,600 investors with over 10 BTC in their wallets, marking a 5% increase from the same period last year.

The category of crypto investors who boast an astonishing 10,000 BTC saw a 14% year-over-year rise, totaling 111. The unique wallets with a significant 1,000 BTC experienced a decline, with their numbers decreasing by 8% from the previous year to 2,015 in July.

Since July of the preceding year, more than 2.1 million new active Bitcoin addresses have been established.

Data from Glassnode illustrates growth in Bitcoin's active addresses this year. The count of active addresses either transferring or receiving BTC on any given day escalated by 15% or 2.18 million since July 2022, hitting 17.6 million in the previous month.

Despite regulatory resistance in the US, Bitcoin addresses with a non-zero balance have reached a historic high. In July of the previous year, the total count of addresses with non-zero balances was 42.2 million, which has now grown to over 47.3 million, reflecting a substantial year-over-year increase of 5.1 million.