Table of Contents

Grayscale Investments, a prominent cryptocurrency investment company, achieved a significant legal win against the Securities and Exchange Commission (SEC).

A federal appeals court ruled in Grayscale's favor, directing the SEC to reconsider its prior refusal of Grayscale's plan to transform its Bitcoin Trust, known as GBTC, into a Bitcoin ETF.

This decision has had a profound impact on the cryptocurrency sector, causing an immediate rise in Bitcoin's value and fostering optimism for the greenlighting of spot Bitcoin ETFs in the U.S.

The legal dispute began when the SEC thwarted Grayscale's efforts to change its Bitcoin Trust into an ETF. In response, Grayscale filed a lawsuit against the SEC in June 2022. They contended that the SEC had inconsistently approved ETFs that invested in bitcoin futures contracts while turning down those that sought to directly hold bitcoin.

The DC Circuit Court of Appeals' three-judge panel sided with Grayscale. They decreed that the SEC must revisit its denial of Grayscale's proposal. This verdict is a significant advancement for U.S. investors and the broader Bitcoin community. It also enhances the likelihood of other asset managers receiving approval for their offerings.

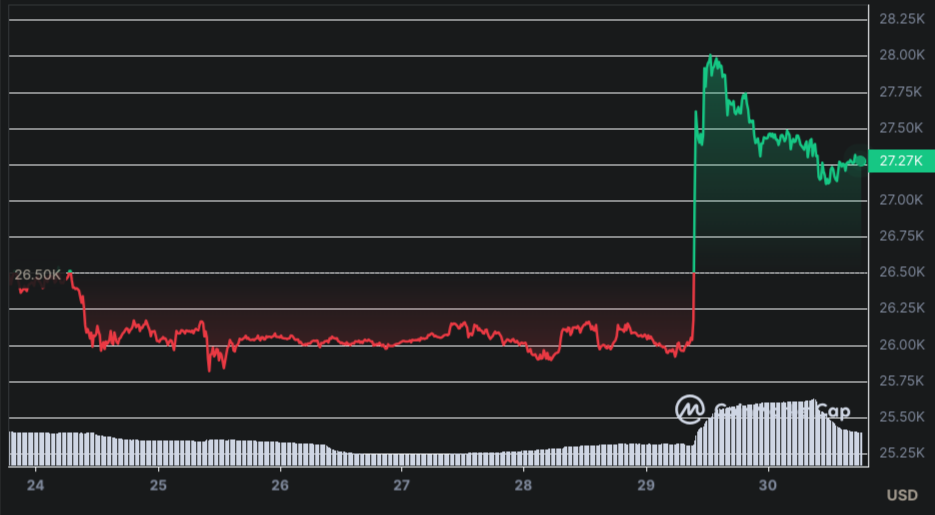

After the court's ruling, Bitcoin's price surged over 5%, surpassing $27,000. This uptick underscores the market's expectations and the profound influence of such a decision.

Notably, Coinbase stocks, the U.S.'s largest cryptocurrency exchange, skyrocketed by over 13%. Meanwhile, shares of bitcoin mining corporations Marathon Digital and Riot Blockchain jumped by 18% and 24%, respectively.

The SEC has been Hesitant to Allow Spot ETFs

Historically, the SEC has expressed reservations about sanctioning spot bitcoin ETFs due to concerns about market manipulation. Yet, this court decision might push the SEC to reexamine its position, potentially paving the way for a U.S. spot bitcoin ETF.

This judgment might also enhance the odds for other asset managers to obtain approval for their products. For instance, BlackRock, the globe's most substantial money manager, submitted documentation to the SEC in June for a spot bitcoin ETF. Other major entities like Invesco and WisdomTree Investments have also revisited their spot bitcoin ETF applications.

SEC to Reevaluate

The court has mandated the SEC to reevaluate Grayscale's application, which it had previously declined. Grayscale's legal representatives are presently scrutinizing the court's verdict and will determine the subsequent actions with the SEC.

While this ruling marks a notable win for Grayscale and the broader cryptocurrency sector, the future remains uncertain. The SEC might still reject Grayscale's proposal, albeit for different reasons. Nevertheless, this court decision has undeniably established a benchmark that could profoundly influence the approval process for spot bitcoin ETFs in the U.S.