Table of Contents

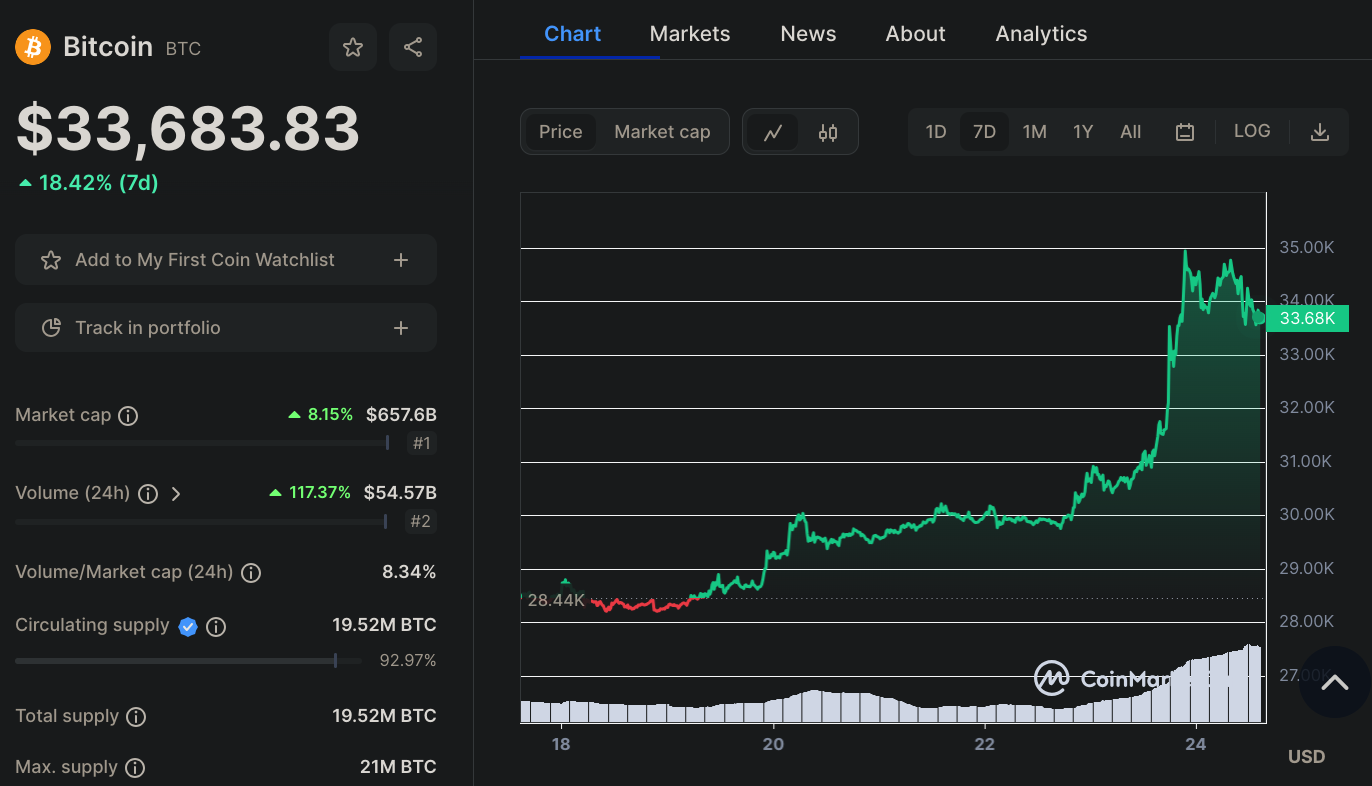

The cryptocurrency market has recently been a whirl of speculation and soaring valuations in the wake of recent news surrounding the potential approval of Spot Bitcoin Exchange Traded Funds (ETFs) in the United States.

This sentiment was initially ignited last week when Cointelegraph erroneously tweeted about the approval of a Bitcoin ETF, sparking a rally in Bitcoin's price.

While one may think this rally would have ended, the price of Bitcoin continues to soar, in anticipation of the approval of a Spot Bitcoin EFT.

Potential Outcome of BTC ETF Approval

As a professional crypto investor and analyst, I find it essential to unravel the influences of these unfolding events on Bitcoin's price and the broader cryptocurrency market. Here are some possible outcomes of this news of the approval of a Bitcoin ETF.

- Initial Spark of Speculation: The incorrect tweet by Cointelegraph acted as a catalyst, setting off a speculative frenzy in the market. Investors, both retail and institutional, began to position themselves to capitalize on the potential approval of a Spot Bitcoin ETF, driving up the demand and, subsequently, the price of Bitcoin.

- Anticipated Surge in Demand: The allure of a Spot Bitcoin ETF lies in its promise of streamlined access to Bitcoin investment, circumventing the technical hurdles of cryptocurrency custody. Financial analyst Tom Lee projected that this elevated demand could push Bitcoin's price beyond $150,000, and potentially even $180,000 should the ETF gain approval.

- Magnet for Institutional Capital: The narrative of a possible Bitcoin ETF, emboldened by reputable institutions like BlackRock, is poised to draw significant institutional capital into the Bitcoin market. This influx of institutional investment is likely to provide a substantial boost to Bitcoin's price, marking a bullish outlook.

- Boost in Liquidity and Scarcity: A Spot Bitcoin ETF, by design, necessitates the actual holding of Bitcoin, which is expected to enhance liquidity while simultaneously increasing Bitcoin's scarcity. This dynamic is set to contribute positively to Bitcoin’s price trajectory.

- Retail Frenzy: The ease of investing in Bitcoin through a Spot ETF is likely to attract a broad spectrum of retail investors. This newfound accessibility is poised to drive a retail investment frenzy, further propelling Bitcoin's price upwards.

- Speculative Fever and Positive Sentiment: The market has already responded to the speculative fever surrounding Spot Bitcoin ETFs, with Bitcoin rallying to $35,000 on the news of BlackRock’s proposed ETF and reaching a 2023 high on ETF bets. This positive sentiment, catalyzed initially by the incorrect tweet, continues to fuel the speculative fervor in the market.

- Projecting Large Inflows: Beyond the speculative phase, research posits that the approval of a Spot Bitcoin ETF could trigger strong inflows of as much as 100,000 BTC within months, potentially pushing Bitcoin's price to above $42,000 during the initial 100 days post-approval.

In summation, the unfolding narrative surrounding Spot Bitcoin ETFs illustrates the significant impact of market sentiment and news dissemination on Bitcoin’s price. The blend of heightened institutional and retail interest, alongside the potential for increased liquidity and scarcity, paints a robust picture of Bitcoin’s bullish trajectory.

As the market navigates through the waves of speculation and anticipation, the saga of Spot Bitcoin ETFs continues to be a compelling storyline in the evolution of the cryptocurrency market.