Table of Contents

Welcome to our weekly crypto market report.

In this report:

- The Week in Review

- Top 100 Gainers (Last 7-days)

- Small Cap Gainers (Last 30-days)

- Monthly Altcoin Pick

The Week In Review

Both in the Top 100 cryptocurrencies (by market cap) and within the small market caps we are seeing an increase in both the valuation and popularity of Web 3.0 projects. These are projects which will help provide the infastructure to the next iteration of the internet, most commonly referred to as Web3.

Fed Hikes Interest Rates (Again)

As expected, the U.S. Federal Reserve & Bank of England both hiked their core interest rates by 75 bps as central banks across the globe scramble to fight inflation.

Instagram Launches NFTs

Instagram users will be able to mint and sell NFTs as the social media platform tests its new digital collectibles feature with a handful of creators. The product will initially launch on the Polygon in the next couple of weeks.

Binance Invests $500 Million into Twitter

This week Elon Musk acquired Twitter for $44 billion dollars with the help of a $500 million dollar investment from Binance, the worlds largest cryptocurrency exchange. Elon has mentioned previously of his intent to incorporate cryptocurrency (previously suggesting Doge Coin) into Twitter. While it's unlikely Doge will be used, with this investment from Binance, it's likely that Binance will be involved with incorporating blockchain technology (and likely a cryptocurrency) as part of the future development of Twitter.

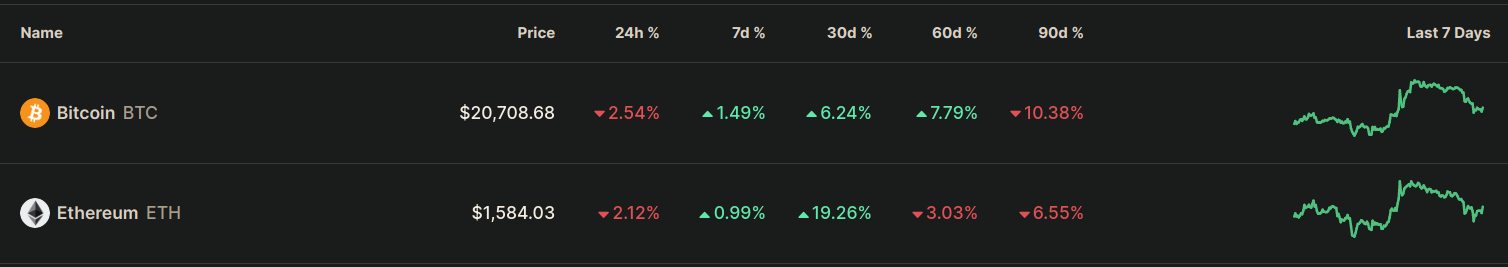

Bitcoin & Ethereum Price Movement

For the last five months, Bitcoin has been hovering around the psychological level of $20,000 (+/-10%) and has remained within this tight band. Ethereum on the other hand did see an increase from $1,300 to over $1,600 two weeks ago, currently sitting at just under $1,600.

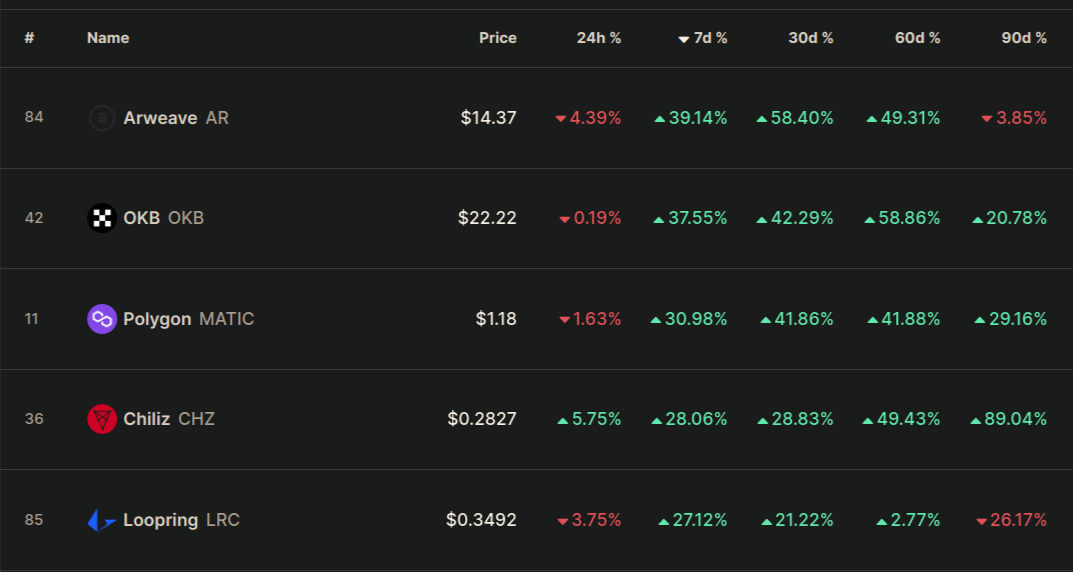

Top 100 Gainers - Last 7 Days

While Bitcoin and Ethereum have continued to trade sideways over the last week, there has been some decent price growth within the Top 100 coins. Namely layer 2, Web3, and exchange tokens.

Arweave (AR) +39% - Rank #84

A decentralized storage network that seeks to offer "indefinite storage" of online data. As we move towards Web3, storage will become an important and necessary component of the transition to Web3.

OKB (OKB) +37% - Rank #42

Token of the Maltese crypto exchange, OKEx. The exchange is one of the largest in the world and currently ranks third in liquidity, fourth in trading volume, and provides a wide selection of trading pairs.

Polygon (MATIC) +31% - Rank #11

Polygon (previously Matic Network) is an easy-to-use platform for Ethereum scaling and infrastructure development. Polygon recently teamed up with Axelar network, a secure communication layer that connects Web3 ecosystems resulting in its price increase.

Chiliz (CHZ) +28% - Rank #36

Chiliz is the leading digital currency for sports and entertainment (Fan Tokens) by the eponymous Malta-based FinTech provider. Last month I wrote about the upcoming World Cup and the impact its publicity will have on the price of fan tokens. Chiliz is the leading Fan token provider and will likely continue to see this token increase (as well as popular teams) throughout the month.

Loopring (LRC) +27% - Rank #85

LRC an open protocol designed for the building of decentralized crypto exchanges. Loopring helps to combine centralized order matching with decentralized on-blockchain order settlement into a hybridized product.

Web 3.0 Projects are trending

Web 3.0 is still in its infancy and as new projects move toward this new iteration of the internet, we will likely see an increase in the utilization and value of projects which provide the backbone to Web 3, as we have already seen with Arweave, Loopring and Polygon in the last week.

Small Cap Gainers in the last 30 days

The greatest gains within the cryptocurrency market are within the nano, micro & small market capitalized projects.

Small Market Cap projects that have performed well over the last 30 days:

- MNDE +256% - Liquid staking protocol built on Solana (Micro-Cap)

- KAS +72% - Kaspa, fastest new fully scalable Layer-1 (Micro-Cap)

- BFR +799% - Buffer: Options trading platform (Nano-Cap)

- GAMMA +168% - Liquidity management on Uniswap (Micro-Cap)

- PSWAP +161% - Cross-chain Liquidity DEX (Nano-Cap)

- MASQ +420% - dMeshVPN, browser, dAppStore (Nano-Cap)

- CANTO +198% - Layer-1 blockchain (Small-Cap)

Liquidity providers (DeFi) have been among the biggest gainers this month (MNDE, GAMMA, PSWAP) as well as new Layer-1 blockchains (CANTO, KAS). Layer-1 blockchains have historically been the highest-appreciating class of cryptocurrencies.

As the market moves to more decentralization (Web 3.0) we will likely continue to see an increase in the utilization and value of liquidity providers.

Every week we review and analyze low-market-cap cryptos looking for the next low-cap gem. To find out our next altcoin pick, be sure to signup as a paid subscriber.

Monthly Altcoin Pick:

Last week we released the Altcoin Pick for October. Our Altcoin pick for November will be released at the end of the month. Our Altcoin Picks for the prior months can be found here.

If you would like to support this publication and have access to member benefits, such as our monthly Altcoin Pick, signup here.

Thanks and appreciation to all our current and prior members!

Until the next report,

Richard