Table of Contents

It's been an interesting week for both the crypto and financial markets and the market response to the recent market data has been...well, unexpected.

On Wednesday (July 27th) - Interest Rate Hike

The Federal Reserve confirmed its interest rate hike of another 75 basis points raise on Wednesday. Interestingly, the crypto and equity markets didn't seem phased by the news. Shortly after the announcement, Bitcoin increased by over $1,000 in less than a day.

It's believed the market had already priced in the interest rate hike, even though this news will further tighten monetary conditions.

On Thursday (July 28th) - GDP Numbers

The official GDP numbers were announced, dropping by 0.9% this quarter. This is the second consecutive quarter there has been negative GDP growth and 'traditionally' this is the definition of a recession.

Yet, it seems the definition of a "recession" is now being redefined in 'real-time'.

Wikipedia changed the definition of recession to favor the Biden regime, and then locked the page. pic.twitter.com/2HvzsavWbu

— Cernovich (@Cernovich) July 28, 2022

The redefinition of the meaning of "recession" is not going unnoticed and Twitter has become a hotbed of comments on the subject.

A lot of people are wondering about the definition of recession. A recession is defined as two consecutive quarters of negative GDP growth if a Republican is president. The definition is far more complicated and unknowable if a Democrat is president.

— David Sacks (@DavidSacks) July 28, 2022

While the current administration tries to downplay the significance of the recent GDP numbers, the market overall seems to be unphased by the recent news.

Crypto Market Update:

Over the last week, the cryptocurrency market is up, reclaiming over a $1 trillion market capitalization in a large part in response to the recent Federal Reserve news.

After the GDP numbers were announced, Bitcoin hit its 30-day high of $24,294.

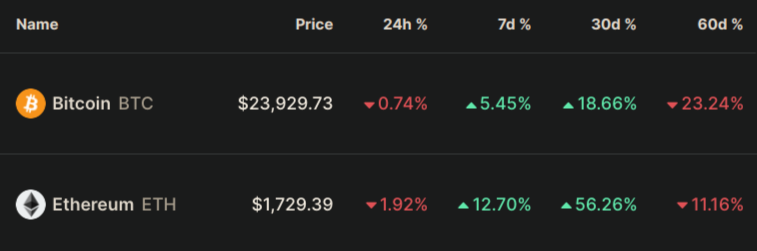

The two largest cryptocurrencies, BTC and ETH are on track for their best month of this year! Bitcoin is up more than 18% in July and Ethereum is up over 56%.

After a dismal first half of 2022, is the crypto market poised for a bull run in the second half?

Is a Bull Run Starting?

This was a very significant week for the markets. In addition to the Federal Reserve announcement of an increase of 75 basis points and U.S. GDP falling for a second consecutive quarter, many big retail and tech companies (Google, Apple, Meta) released their second-quarter earnings which had a significant impact on the stock market.

Even though the commonly understood definition of a recession is a fall in GDP over two consecutive quarters, President Joe Biden and Fed Chairman Jerome Powell both said this week that the U.S. is not in a recession.

The market response to this week's market data is very encouraging and while it's still too early to say whether we are in a bull run, the outlook is optimistic. Some experts are suggesting crypto is ready to run 100%-200% in the short term.

What This Week’s Crypto Rally Means for Investors

While important, if you are investing in cryptocurrencies for the long term, these recent developments shouldn't alter your investment strategy.

It's important to reaffirm that cryptocurrencies are highly volatile, especially during times of economic uncertainty. What is certain is we are at near or low bottom levels from just a year ago and it is around this time of the market cycle to be accumulating and building your portfolio.

Whether this is the bottom and the market is turning bullish or simply a bull trap, accumulating quality crypto projects and dollar cost averaging in at these low prices is an excellent strategy.

Altcoin Pick for July:

Our altcoin pick for July is up 100% over the last 30 days and is expected to continue to increase as one of the next big upcoming Metaverse projects. It also makes for a great long-term hold.

Access to our monthly Altcoin Picks is included in member benefits and if you are not yet a member, you can signup here to get full access.

Upcoming Reports for August:

In August we will be featuring:

- Significance of ISO20022 Projects and our top pick

- Passive Income Cryptos (DeFi Lending & Liquidity Tokens) and our top pick

Until the next report,

Richard