Table of Contents

Following the news of Russia’s occupation of Ukraine, a lot of significant news is taking place within the cryptocurrency markets.

There has been a spike in BTC whale addresses following news of financial sanctions to be placed against Russia and while Bitcoin did take a massive dip on the initial news of Russia’s “special operations” within a few days it has made some of the largest gains we have seen in over a year, rallying near $45,000.

Financial Sanctions Imposed on Russia

Soon after Russia initiated its “special operations” in Ukraine, the international community enforced sanctions against both the country and top Oligarchs within the country. This has included removing access to the global banking system (SWIFT) and just recently both Mastercard and Visa have now cut access to Russian banks.

Spike in whale BTC addresses

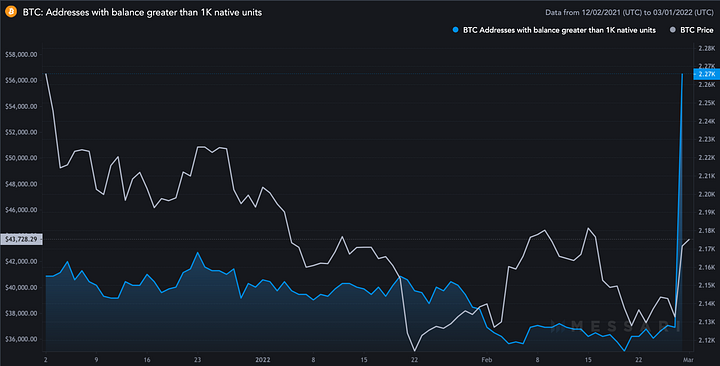

Soon after news of Russia’s “special operations” in Ukraine, the number of BTC addresses holding at least 1,000 BTC (considered “whales”) increased significantly, from 2,127 on February 27th to more than 2,266 within 24 hours.

It’s suspected many of the wealthy Oligarchs of Russia have moved their funds to Bitcoin, causing this spike in whale accounts.

Russian Stock Exchange Shut

Russia shuts its stock market for a 3rd day in an attempt to stop panic selling and the Russian Ruble is now worth less than one cent, dropping more than 30% against the dollar on Monday.

Russia has even threatened to seize its citizen's bank accounts if the sanctions are to continue. This has caused massive queues at ATMs all across the country with Russians withdrawing their cash.

As a result, Bitcoin is being traded at a premium of over 20% (an excellent arbitrage opportunity exists there now) within Russia.

Bitcoin — Now an Apolitical Safe-Haven Asset

In times of war, asset protection is essential and never before has an individual had the ability to ‘hold safe’ millions of dollars worth of wealth by only needing to remember a 12-seed phrase.

With the massive increase in “whale” BTC accounts and now the massive 20% premium on Bitcoin, we are seeing many Russians move to BTC as a safe haven asset.

As unfortunate as this crisis in Ukraine is, it is forcing greater adoption of cryptocurrency and solidifying its place within worldwide currency markets.

As the President of El Salvador, Nayib Bukele recently tweeted:

“The intrinsic value of #Bitcoin is now on full display for the whole world”

The intrinsic value of #Bitcoin is now in full display on the whole world.

— Nayib Bukele 🇸🇻 (@nayibbukele) March 1, 2022

As more sanctions continue the populations of both Russia and Ukraine (which make up about 186 million people) are looking to cryptocurrency as both a safe haven for their assets and store of value.

During this unfortunate time of conflict, it would seem that Bitcoin (and cryptocurrencies at large) are becoming an apolitical safe haven and the intrinsic value offered by cryptocurrency are now on full display for all citizens of the world to see.