Table of Contents

A lot of news to cover this week, starting with the recent market crash following the invasion of Ukraine by Russian forces.

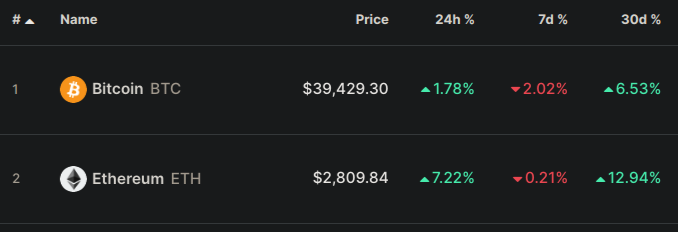

Bitcoin dropped to a low of $34,459 on February 23rd with the news of Russia invading Ukraine. The price of Bitcoin has since recovered to $39,357 however the invasion has only begun and both the crypto and stock market are highly susceptible to news of war.

Canada's Emergency Act Declares War Against Crypto

Meanwhile, on the other side of the world, the Government of Canada has invoked "emergency rules" which have led to the seizure of bank and cryptocurrency accounts, including $20 million dollars worth of crypto and $10 million dollars donated to the trucker convoy GoFundMe account.

These "emergency rules" have been put in place to combat the trucker convoy which has garnered international attention over the last few weeks. These new rules are to prevent funds from making their way to support the trucker convoy.

As a result, the Canadian government has directed that banks, cryptocurrency exchanges, money remittance businesses, fundraising platforms and holders of any cryptocurrency wallets immediately halt all transactions in connection with the convoy’s accounts and e-wallets.

The Ontario Superior Court of Justice signed an injunction freezing crypto assets for over 120 different wallet addresses. These addresses are associated with various different cryptocurrencies, including Bitcoin, Cardano, Ethereum, Litecoin, and Monero.

— no bullshit bitcoin (@nobsbitcoin) February 16, 2022

Kraken CEO: "get your coins out" of centralized exchanges

The Canadian government’s unprecedented seizure of its citizens' bank and cryptocurrency accounts has spurred Jesse Powell, the CEO of Kraken to speak out. He told followers on Twitter to "get your coins out" of centralized exchanges revealing that Kraken would also be forced to comply with any seizure requests.

Sharing a similar sentiment, the CEO of Coinbase, Brian Armstrong tweeted his concerns over the recent developments in Canada while highlighting the importance of keeping crypto funds in a self-custodial wallet.

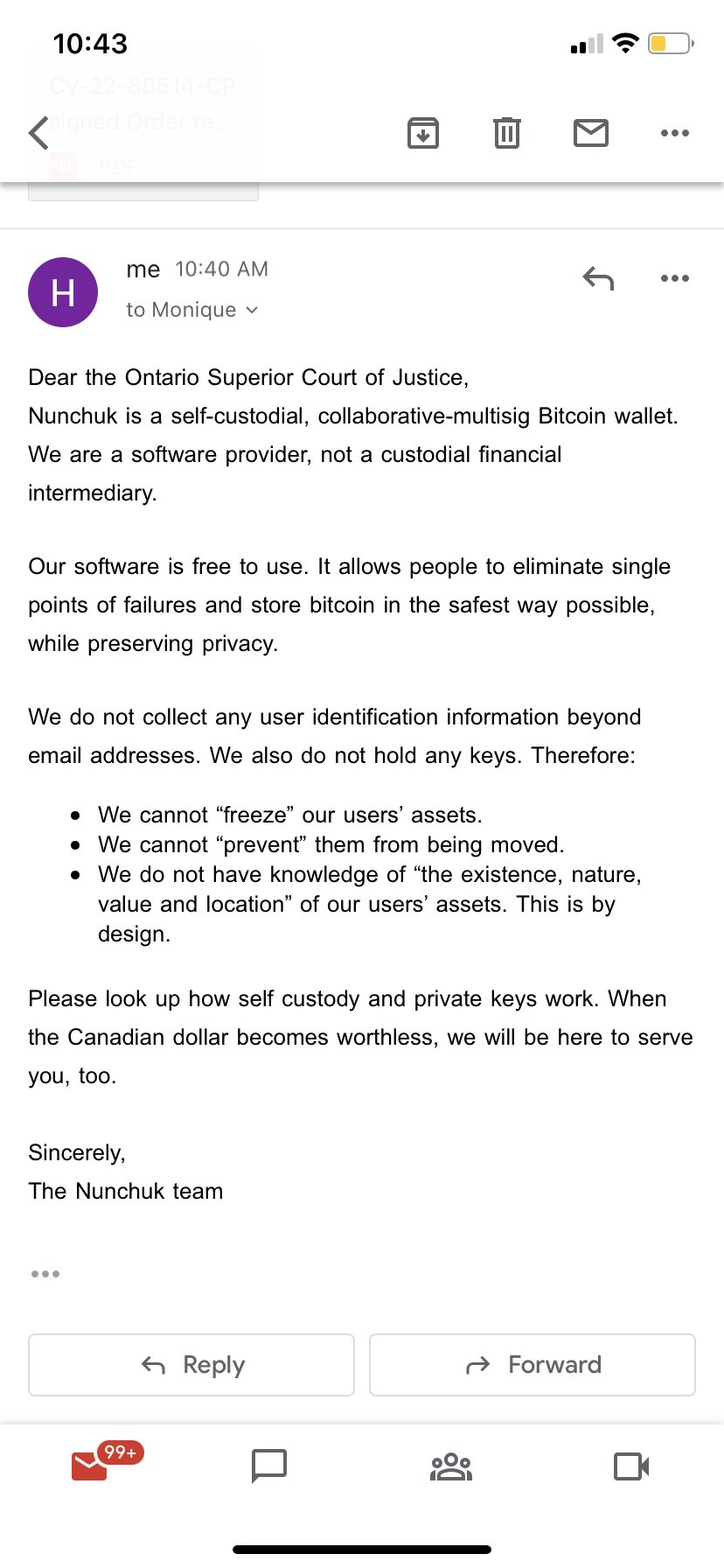

Self Custodial Wallet - Nunchuk

In a rather entertaining turn of events, the Ontario Superior Court of Justice sent Nunchuk a self-custodial Bitcoin wallet, an order to freeze and disclose user information about the assets they had under their custody. Their response was priceless...

Importance of Hardware Wallets

Whether or not you are in Canada, these recent actions by the Canadian government are an important reminder for all cryptocurrency investors to ensure the safe custody of their cryptocurrency.

One of the best ways to ensure the safety of your cryptocurrency assets is to store them on a hardware wallet. My favorite hardware wallet is Trezor, but there are many other hardware wallets on the market to choose from. If you aren't yet using a hardware wallet, this is your reminder.

CBDC - The New Gov't (Digital) Currency

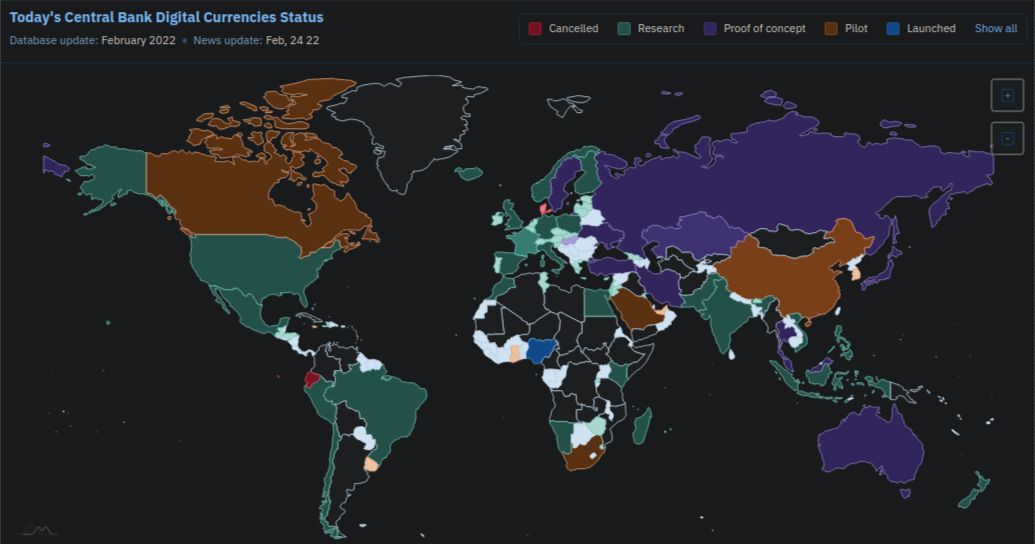

Many people are not yet aware, but about 80% of worldwide central banks are engaged in the research of and development of a "Central Bank Digital Currency".

Nigeria is the first country to already launch its own CBCD (eNaira).

There are also 18 countries already piloting their CBCD program including France, South Africa, Jamaica, China and Canada - the same country which has put in place legislation to lawfully seize its citizen's cryptocurrency accounts.

The Digital Dollar, Digital Yuan and Digital Euro coming to a country near you.

Upcoming Ban on Crypto?

What we have already seen happen in Canada may foreshadow a greater restriction on cryptocurrency use.

Getting back to the conflict with Russia, the West has already imposed financial sanctions on Oligarch banks and placed restrictive controls on technology. As the invasion of Ukraine continues, it's likely further sanctions will be imposed. These additional sanctions may include removing Russia's access from the communications infrastructure to access the global financial system and the SWIFT payment system.

What is important to note is we are already seeing cryptocurrency being used to fund this conflict.

Blockchain analytic firm Elliptic has determined that millions of dollars worth of Bitcoin donations have been funneled to the Ukrainian military to support the country.

If additional financial sanctions are imposed against Russia (such as removing access to the SWIFT payment system), it's likely we will see a major uptake in cryptocurrency transactions within the country (A side note, only two weeks ago Russia decided to legalize cryptocurrency transactions).

We have already seen the Government of Canada target cryptocurrency transactions of the Truckers Convey. If authorities declare that cryptocurrency is illegally used by Russia in this conflict (blame Russia narrative), as part of international sanctions, there is the possibility of banning (or otherwise significantly limiting) the use of cryptocurrency.

While the above statement is highly speculative, what isn't is many sovereign countries will be looking to launch their own CBDC in the next few years. Will the existing cryptocurrency market be allowed to operate alongside these CBDCs? We will just have to wait and find out.

There is a lot happening in the world, especially in regards to the regulation, legalization and taxation of cryptocurrencies. If the message is not yet clear, here it is - if you have crypto sitting on centralized exchanges, take the advice of the CEOs of these exchanges - take your crypto off centralized exchanges and store them in either self-custodial or hardware wallets where you are the only one with custody of the private key. You've probably heard it many times before, not your keys, not your crypto.

Trade safe,

Richard