Table of Contents

The International Monetary Fund (IMF) is spearheading the development of a platform for Central Bank Digital Currencies (CBDCs) to facilitate transactions between countries and foster global financial inclusion. This move is part of the growing trend among central banks worldwide to explore the potential of digital currencies in the evolving financial landscape.

IMF Managing Director, Kristalina Georgieva, emphasized the need for a common regulatory framework for digital currencies that will allow for global interoperability. The platform is intended to prevent a fragmented approach to CBDCs, where each country develops its own system. The lack of a common platform, Georgieva warns, could create a vacuum that cryptocurrencies, which are decentralized, could fill.

There's substantial momentum in the CBDC landscape, with 114 central banks currently exploring the concept. Approximately 10 of these institutions have already completed the development and implementation of their CBDCs. However, Georgieva stressed that if countries focus solely on domestic deployment, the full potential of CBDCs would be underutilized.

CBDCs offer the potential to increase financial inclusion and make remittances cheaper. Presently, the average cost of money transfers is 6.3%, which amounts to $44 billion annually. CBDCs could help reduce these costs. Furthermore, Georgieva insisted that CBDCs should be backed by assets. She considers cryptocurrencies backed by assets as investment opportunities, while those not backed by assets are viewed as speculative investments.

While the IMF's initiative has sparked considerable interest and received support from central banks globally, it's still in its early stages. Numerous countries are already exploring CBDCs and initiating related projects. By working together on a global CBDC platform, countries can learn from each other's experiences, share best practices, and collectively shape the future of digital currencies.

However, this transition presents several challenges that need careful consideration. These include privacy concerns, cybersecurity risks, and potential disruptions to the existing financial system as well as other dangers CBDCs pose. To address these issues, the IMF and participating central banks are committed to developing robust technological infrastructure, conducting rigorous risk assessments, and fostering international cooperation.

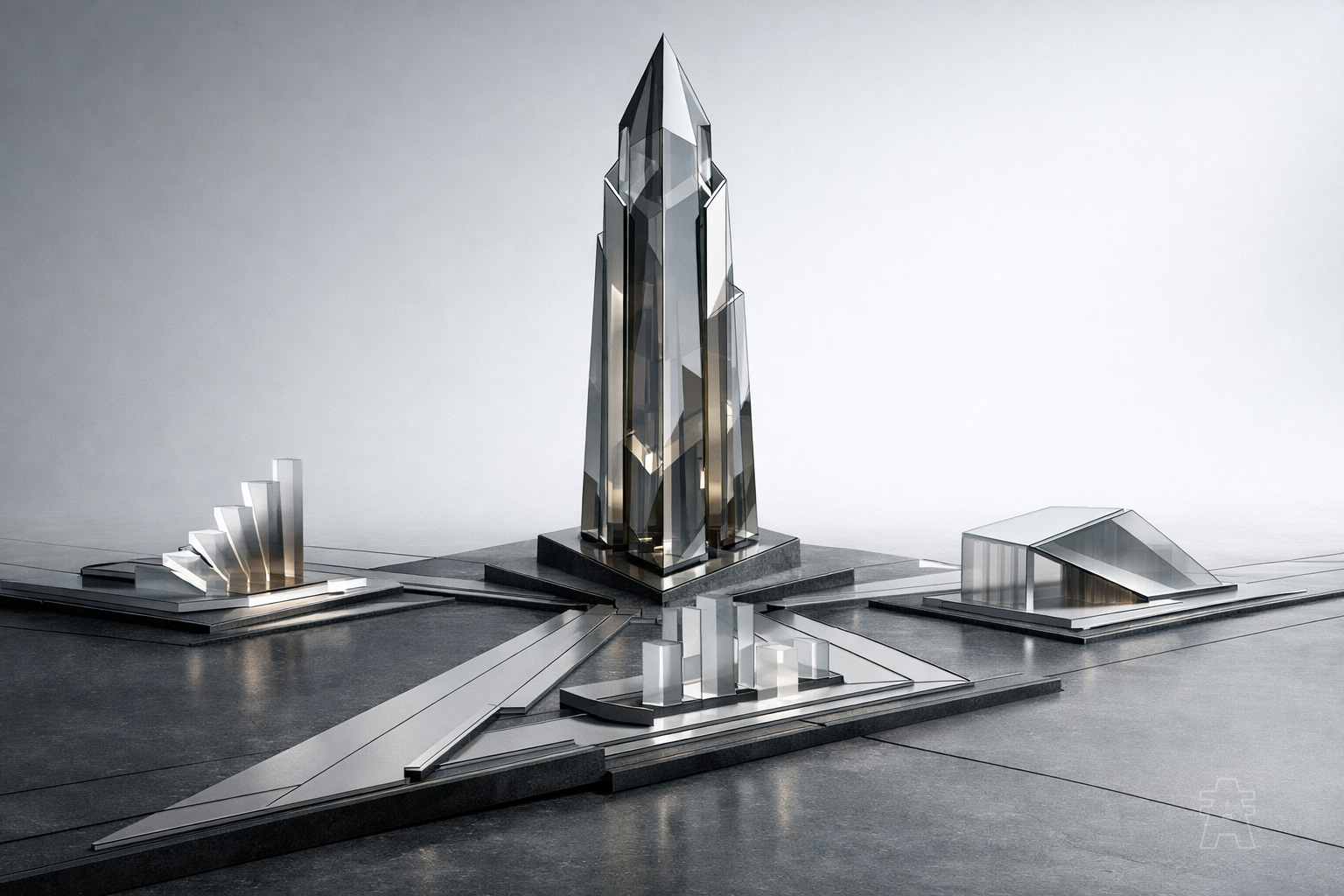

The IMF's efforts to establish a global CBDC platform signify a significant milestone in the evolution of the financial landscape and move toward what many are calling the New Quantum Financial System. The initiative promises to revolutionize cross-border transactions and foster financial inclusion, while challenges like privacy and cybersecurity need to be managed effectively. As more countries collaborate and learn from each other, the future of digital currencies is being shaped, ensuring a more efficient, inclusive, and secure global financial ecosystem.