Table of Contents

It's been a crazy week in the crypto markets and we are seeing some unprecedented events taking place; the de-pegging of stable coins.

Quick Market Recap

Bitcoin is currently trading at $26,655 and ETH at $1,784, both down more than 50% in the last six months with BTC down over 12% and ETH down over 21% in just the last 24 hours.

The cause of this massive recent drop in crypto is the recent de-pegging of the stable coin Tether (USDT), on the heels of the already de-pegged stable coin TerraUSD (UST).

Tether, the 3rd highest ranked cryptocurrency has just lost its pegging to the US dollar. If this continues it will mark a disaster for the cryptocurrency markets.

What is a Stable Coin?

A stable coin is a cryptocurrency for which the value is pegged (or tied) to another currency, in the case of most cryptocurrencies this is the US dollar.

Stable coins have been a place of safe haven for cryptocurrency investors wanting to keep their investments within the cryptocurrency market and not have to worry about the risk of price volatility, until now.

De-Pegging of Terra USD (UST)

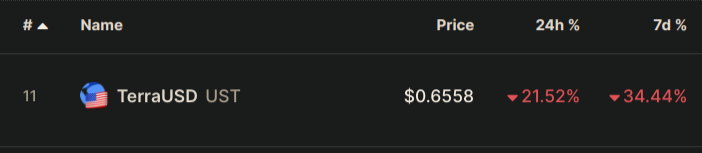

The big news this week was the de-pegging of the Terra stable coin, UST which caused a massive drop in investor confidence and the sell-off of Terra (LUNA).

As UST lost its pegg, dropping down to a low of $0.29, investors sold their holdings of Terra (LUNA), the blockchain protocol that supports the fiat-pegged Terra USD (UST) and as a result, it has now dropped +99% in just the last 7-days.

How did Luna Lose its Peg?

To understand how TerraUSD (UST) lost its peg to the US dollar, it's necessary to understand that UST is not backed by US dollars, rather the UST is algorithmically determined by buying and selling its cryptocurrency reserves (mostly Bitcoin).

Yellen hired Citadel to break UST peg so U.S. government can increase regulatory scrutiny on crypto send tweet

— Steven (@Dogetoshi) May 10, 2022

It is rumored that this attack on UST was an orchestrated economic hit on the stable coin where Citadel Capital and BlackRock may be involved.

Rumor is citadel is the culprit. pic.twitter.com/91F0jGnl5k

— Jacob Canfield (@JacobCanfield) May 10, 2022

De-Pegging of Tether

In the early hours of this morning, the first signs of Tether de-pegging from the US dollar have been seen, dropping to a low of $0.95. I am hopeful that Tether will be able to maintain its peg, but if it isn't it will greatly compound the already bad situation the market is in.

Stable Coins will Be Regulated...

Soon after the collapse of Terra, the US Treasury Janet Yellen has already come out to say that stable coins need to be regulated.

Already the US SEC is making plans to expand its cryptocurrency enforcement, which will include DeFi, stable coins and NFTs.

At this point, I want to pause and reflect on the Hegelian dialectic - also known as Problem - Reaction - Solution.

It's where a problem is created for the sole purpose to direct a predefined solution. In this case, stable coins are a threat to the fiat monetary system and an orchestrated de-pegging of a stable coin(s) could create a perfect environment to justify the implementation of new regulations within the stable coin space.

The Market Outlook

The events which are currently unfolding are and will continue to have a dramatic and negative impact on the market. It's also my suspicion the de-pegging we are seeing will help to justify new cryptocurrency regulations, especially pertaining to stable coins which will likely come out soon.

The last couple of days has been some of the toughest I have seen in crypto. There is no denying we are in a bear market and will likely be for some time ahead. This is a difficult period of time for many people, myself included as our portfolios are in the red.

As with all markets, there are cycles. Crypto will not go to zero. It is here to stay and in the near term, there will likely be some extraordinary opportunities opening up. In the meantime, for myself, I will be standing by the sidelines until the dust has settled.

Until the next report,

Richard