Table of Contents

Welcome to our weekly crypto market report.

In this report:

- The Week in Review - FTX & its impact on the market

- Top 100 Gainers (Last 7-days) - Gold-backed crypto

- Small Cap Gainers (Last 30-days) - Web 3.0

- Monthly Altcoin Pick - November

The Week In Review

The big news this week is FTX, earlier in the week which suffered a liquidity crisis, has declared bankruptcy and most recently looks like a hacker has drained all its funds!

All this and more in less than a week.

What happened to FTX?

The decline of FTX began with a tweet from the CEO of Binance on Sunday, November 7th tweeting they would liquidate their position in FTX.

As part of Binance’s exit from FTX equity last year, Binance received roughly $2.1 billion USD equivalent in cash (BUSD and FTT). Due to recent revelations that have came to light, we have decided to liquidate any remaining FTT on our books. 1/4

— CZ 🔶 Binance (@cz_binance) November 6, 2022

However, it was soon discovered by on-chain analysts that FTX was running low on reserves, resulting in more panic and the price dropped from $25 to under $4.

That evening, at 9:53 pm on November 8th, restrictions were placed on withdrawals, preventing customers from withdrawing their funds from the exchange. This is when full panic broke out.

The next day, FTX asked Binance for help and they signed a non-binding letter of intent with the intent to fully acquire FTX.

This afternoon, FTX asked for our help. There is a significant liquidity crunch. To protect users, we signed a non-binding LOI, intending to fully acquire https://t.co/BGtFlCmLXB and help cover the liquidity crunch. We will be conducting a full DD in the coming days.

— CZ 🔶 Binance (@cz_binance) November 8, 2022

Within a few hours of due diligence, Binance withdrew its offer.

On November 10th, FTX filed for Bankruptcy.

Chapter 11 Bankruptcy was filed, and then the next day, the rumor is abound that the FTX funds have been drained.

FTX Funds have been drained (Hacked?)

Most recently, customers have been warned not to download or log into their FTX accounts due to some kind of hack on FTX.

Investigating abnormalities with wallet movements related to consolidation of ftx balances across exchanges - unclear facts as other movements not clear. Will share more info as soon as we have it. @FTX_Official

— Ryne Miller (@_Ryne_Miller) November 12, 2022

The rumor is that a hacker (who had the keys to all the accounts) has now drained all the funds of FTX. While this news is still dripping wet, a good summary of what we know so far was just recently written by CryptoNews:

What happens next?

Unfortunately, it's likely we have not seen the full impact of the fall of FTX as many hedge funds, and other cryptocurrency projects were also heavily invested in either Alameda Research or FTX Ventures.

If you were invested in FTX, my condolences. Earlier this year there was Luna, now it's FTX.

Cautionary Note:

If you have been a long-time reader, you will know I have warned my subscribers to not leave their crypto on exchanges. This is even before the Luna crisis. FTX is just the next in a likely series of exchanges that will either freeze user funds and/or declare bankruptcy in the process. We will also likely see new crypto regulations due to these events coming into play in the upcoming months which will further restrict how cryptos are traded.

Use a Hardware Wallet

A much safer and more private method to safeguard your crypto is to store your crypto assets in a hardware wallet, like Trezor or Ledger. These devices also allow you to swap and exchange crypto assets (in many cases without KYC) within the wallet, thereby negating the need for a centralized exchange or KYC while still maintaining your anonymity.

Privacy & Anonymity

If you are interested in both privacy and anonymity, please understand 99% of cryptocurrencies are considered to be surveillance coins. If you are looking to truly be anonymous and private, you should be looking into including a privacy coin in your portfolio. Here are some privacy coins to consider.

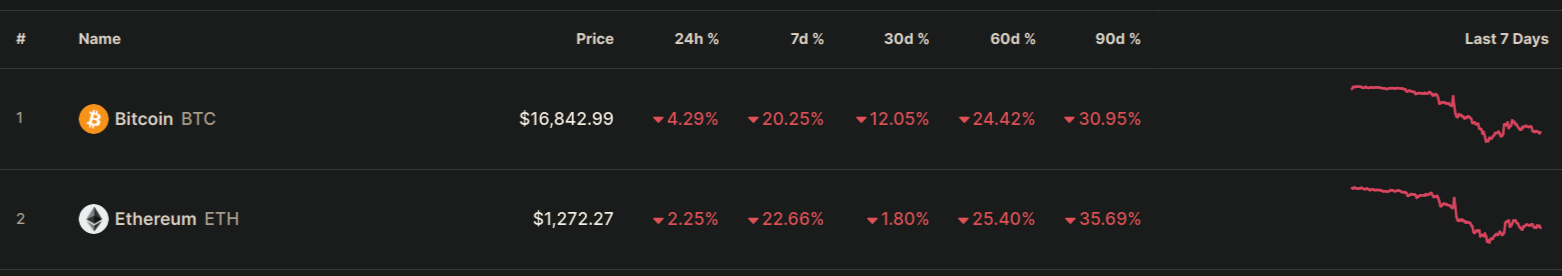

Bitcoin & Ethereum Price Movement

A few days ago Bitcoin hit its lowest price in over two years, with an all-time low of $15,682 on Wednesday. While the price of Bitcoin has recovered slightly, the FUD in the market as well as the unfolding events of the FTX saga are continuing to cause fear in the market.

Ethereum has also dropped to one of its lowest prices in recent months ($1,083), currently, it is trading at $1,272.

Future Bitcoin Price?

A few months ago, I published an article Bitcoin (End-of-Year) Price Prediction 2022 where I analyze the prior Bitcoin end-of-year price movements for prior year bear markets and made a price prediction for the end of 2022.

TLDR: The price of Bitcoin (and the rest of the market) will likely continue to decline into December and January before any substantial recovery can be expected. This is based on prior year analyses of Bitcoin price in bear markets.

Top 100 Gainers - Last 7 Days

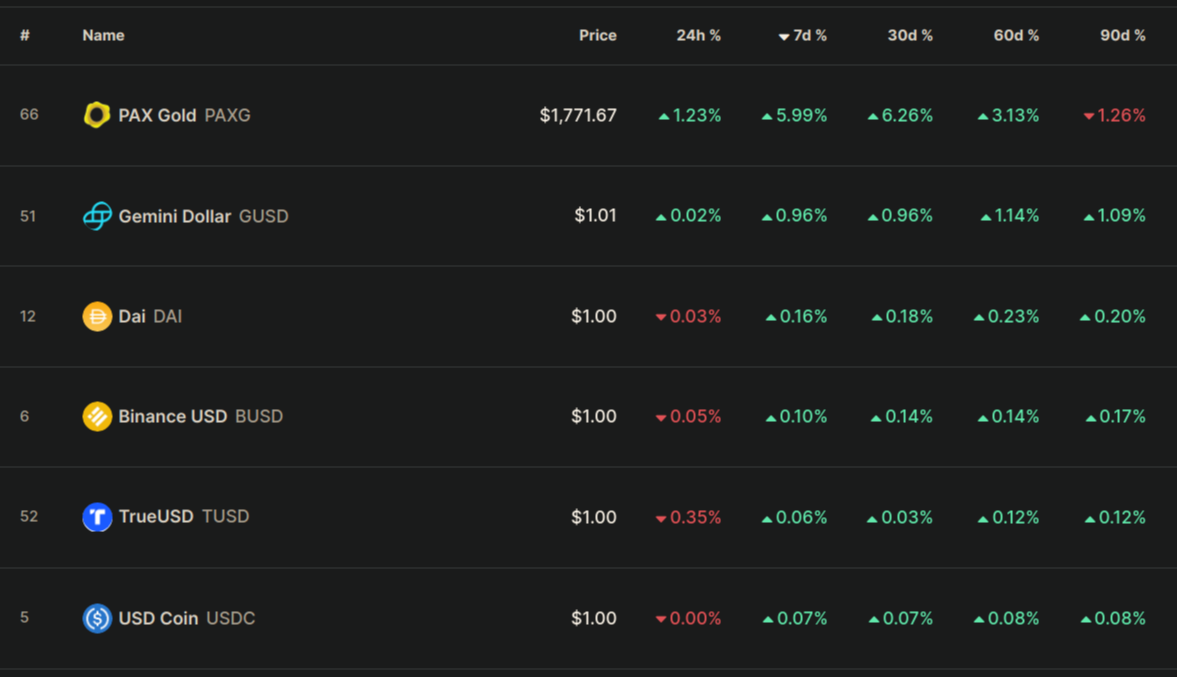

Over the last week, the charts have been a sea of Red. While for some, seeing so much red can be unnerving, analyzing the markets during these times can be very revealing.

As to be expected, the bulk of cryptos on this list are stablecoins, as most all cryptocurrencies in the Top 100 have taken massive losses this week...except for one!

The anomaly is PAX Gold (PAXG) which has actually made gains!

PAX Gold (PAXG) +6% - Rank #66

Pax Gold (PAXG) is a gold-backed cryptocurrency, launched in September 2019 and is an ERC-20 token. This is a crypto and gold hybrid that bridges the gap between the two investment options, gold and cryptos.

PAX Gold is backed by real gold reserves held by Paxos and each PAXG token is linked to a 1:1 ratio to one troy ounce (t oz) of a 400-ounce London Good Delivery gold bar stored at Brinks Security vaults in London. The Paxos-backed cryptocurrency, PAXG, is backed by the London Bullion Market Association (LBMA) certified gold bars and may be redeemed for actual bullion.

The market price for PAX Gold follows the market price of a troy ounce of gold:

Gold Backed Cryptocurrency

A Gold-backed cryptocurrency is certainly a new use case for the crypto market and knowing that this particular cryptocurrency can be redeemed for actual bullion is certainly reassuring in these times. This is a project worth further research and may be a viable alternative to traditional stablecoins.

Small Cap Gainers in the last 30 days

The greatest gains within the cryptocurrency market are within the nano, micro & small market capitalized projects.

Despite the recent market downturn, these are the small market cap projects that have retained their gains over the last 30 days:

- MNDE +239% - Marinde - Liquid staking protocol built on Solana (Micro-Cap)

- DC +105% - DogeChain - Brings NFTs, games, and DeFi to Dogecoin (Nano-Cap)

- PHA +100% - Phala - Privacy & Trustless Computing for Web 3.0 (Micro-Cap)

- MASQ +235% - dMeshVPN, browser, dAppStore, Web 3.0 (Nano-Cap)

- BFR +262% - Options Trading Platform (Nano-Cap)

As the market moves to the next iteration of the web (Web 3.0), it's likely we will continue to see more projects which provide the necessary Web 3.0 infrastructure to perform well.

Every week we review and analyze low-market-cap cryptos looking for the next low-cap gem. To find out our next altcoin pick, be sure to signup as a paid subscriber.

Monthly Altcoin Pick:

We will be releasing our Altcoin pick for November at the end of the month. Our Altcoin Picks for the prior months can be found here.

If you would like to support this publication and have access to member benefits, such as our monthly Altcoin Pick, signup here.

Thanks and appreciation to all our current and prior members!

Until the next report,

Richard