Table of Contents

In this report:

- Why is the Crypto Market Down this Week?

- AI Crypto Trading Bots

- Top 100 Gainers (7-days): Kava (KAVA) +16.2% (7d)

- Micro-Cap Gainers (30-days): Fief (FIEF) +1,021% (30d)

- Monthly Altcoin Pick: May's Altcoin Pick will be released at the end of the month

Why is Crypto Down This Week?

I first wrote about this on Monday, Bitcoin transaction fees have skyrocketed to a 2-year high with some users reporting $20-$25 transaction fees.

On Monday, unconfirmed transactions were sitting at 390,000 - Today, it's a little lower, sitting at 317,607. This means there are over 317k transactions are still waiting to be processed.

Transactions are processed according to transaction fees, the more you pay, the faster your transaction will be processed, which has resulted in many users having to pay upwards of +$20 per transaction to get their transactions confirmed - resulting in massive profits for Bitcoin miners.

Why so many unconfirmed transactions?

Bitcoin, the world's most expensive and well-known cryptocurrency is the first cryptocurrency ever created and while it is continually being improved, it was not originally designed to handle the increase in blockspace required by layer-2 applications (and protocols).

The cause for unconfirmed transactions and the resulting increase in Bitcoin transaction fees are attributed to an increase in demand for block space - driven by the popularity of the Ordinals protocol and BRC-20 tokens.

The market has pulled back as a result

Bitcoin dominance is sitting at 46.2% and as a result, Bitcoin's price action has a massive impact on the market, where Bitcoin goes, the rest of the market follows.

Bitcoin has dropped in price by 11% this week and as you will see in the charts below, as a result, the crypto market is in the red.

While it's not known how long this issue will continue, what is certain is with such high transaction fees, both the price of BTC and the rest of the market will likely continue to fall until this issue has been corrected.

The Contrarian Investor

While most people fear seeing the market in the red, market drops like this offer a good opportunity to buy into the market when crypto prices s are down. If the confirmed transactions and resulting high transaction fees continue to be a problem, it's likely we will continue to see a drop in BTC as well as the rest of the market - offering a good buy-in opportunity.

AI Crypto Trading Bots

Over the last few weeks, we have been spending a lot of time researching artificial intelligence crypto bot trading. These are trading robots using AI technology to automatically make trades. There are hundreds of crypto trading bots, but only a handful of AI trading bots that use AI technology to make their trades.

The best AI trading bot we have found is called Stoic.ai and they have claimed to have made over 2,143% since March 2020. Not bad considering once it is set up. You don't need to touch it - it automatically does all the trades for you.

We wrote our review here: Stoic.ai: AI Trading Bot Review (2023)

For more on AI trading bots, check out: Top 6 AI Trading Bots for 2023

Crypto Market at a Glance (7D):

Lots of red in the market for this week.

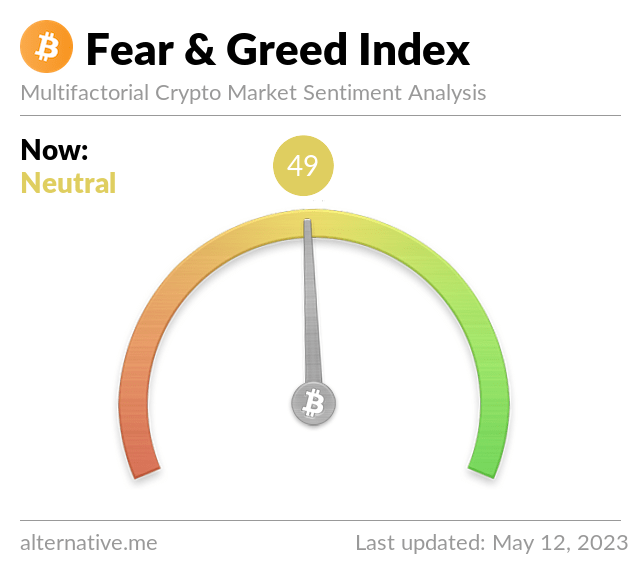

Crypto Fear & Greed Index:

Today's Crypto Fear and Greed index = Neutral -- Decreased to 49 (from 61 last week).

Bitcoin & Ethereum Price Movement

Bitcoin has decreased 11% in the last week, currently trading at $26,322 (90-day high of $31,005). In the previous 90 days, Bitcoin has increased by 21.0%.

Ethereum has decreased 11.3% in the last week, currently trading at $1,769 (90-day high of $2,137). In the previous 90 days, Ethereum has increased by 16.1%.

Global cryptocurrency market capitalization decreased slightly this week from $1.198T to $1.102T.

Top 100 Gainers - Last 7 Days

Over the last 7 days, the biggest gainers (within the top 100):

Kava (KAVA) +16.4% - Ranked #81

Kava (KAVA) is a cryptocurrency and blockchain platform designed to provide decentralized financial services, also known as DeFi (Decentralized Finance), to users across the globe. It is built on the Cosmos blockchain, which enables interoperability between different blockchain networks.

Kava aims to bridge the gap between cryptocurrencies and traditional financial systems by offering a wide range of financial services, including lending and borrowing, stablecoins, and decentralized trading. The platform allows users to collateralize their digital assets and borrow other cryptocurrencies or stablecoins in return. It also supports the creation of stablecoins, pegged to real-world assets like the U.S. dollar, providing stability in a volatile cryptocurrency market.

One of the notable features of Kava is its ability to enable cross-chain transactions, allowing users to interact with assets from different blockchain networks. This interoperability expands the potential use cases and accessibility of Kava.

The native cryptocurrency of the Kava platform is called KAVA. It serves as a utility token within the network, facilitating various functions such as participating in governance decisions, paying fees, and securing the network through staking. Additionally, KAVA token holders can earn rewards by participating in the platform's staking mechanism.

Bitcoin SV (BSV) +4.04% - Ranked #61

Bitcoin SV (BSV) is a cryptocurrency that emerged as a result of a contentious hard fork from the original Bitcoin (BTC) blockchain in November 2018. BSV stands for "Bitcoin Satoshi Vision," and its proponents claim that it restores Bitcoin to its original vision as outlined by Satoshi Nakamoto, the pseudonymous creator of Bitcoin.

The primary objective of Bitcoin SV is to scale the blockchain to accommodate large transaction volumes and provide a platform for various applications and services. BSV proponents believe in maintaining the original Bitcoin protocol and increasing the block size limit to achieve higher transaction throughput.

Some of the distinguishing features and goals of Bitcoin SV include:

- Larger block size: Bitcoin SV aims to have larger block sizes, initially starting at 128MB and potentially scaling even further. The larger block size is intended to allow more transactions to be processed in each block, potentially increasing transaction speed and scalability.

- Enhanced scripting capabilities: Bitcoin SV also seeks to enable more advanced smart contract functionalities on its blockchain by expanding the scripting capabilities. This feature enables developers to create and deploy complex decentralized applications (dApps) on the BSV network.

- Data storage and micropayments: Another focus of Bitcoin SV is to provide efficient data storage capabilities on the blockchain. The protocol allows users to store and retrieve large amounts of data, paving the way for applications like tokenization and timestamping. Additionally, BSV aims to enable micropayments by lowering transaction fees and facilitating microtransactions.

It's worth noting that Bitcoin SV has been a subject of controversy and is considered by some as a contentious fork. The Bitcoin community has diverse opinions on its legitimacy and adherence to the original Bitcoin vision. As with any cryptocurrency investment, it's essential to conduct thorough research and exercise caution, as the market is highly volatile and unpredictable.

UNUS SED LEO (LEO) +0.42% - Ranked #20

UNUS SED LEO (LEO) is a cryptocurrency issued by Bitfinex, one of the world's largest cryptocurrency exchanges. LEO was launched in May 2019 as a utility token to serve various functions within the Bitfinex ecosystem.

The primary purpose of LEO is to provide users with discounted fees when trading on the Bitfinex platform. Holders of LEO tokens can benefit from reduced trading fees, which incentivizes them to hold and use the token on the exchange.

LEO operates on the Ethereum blockchain, utilizing the ERC-20 token standard. It's important to note that LEO is primarily associated with the Bitfinex platform and its ecosystem, and its value and utility are directly linked to the success and adoption of the exchange.

Best Micro Cap Research Tool

If you missed out on the Pepe craze and looking for the next freshly minted meme coins which are getting traction (it's how I originally found Pepe), or just want to get in early on a brand new project with great potential- check out Moralis Money.

First, read our 100x Altcoin strategy article which discusses how to use this tool.

Biggest Micro-Cap Gainers in the last 30 days

Every week we review and analyze small and micro market cap cryptos looking for the next low-cap gem. These are the best-performing (quality) micro-cap projects over the last 30 days:

Best Performing Quality Micro Caps (Last 30 days):

- FIEF +1,021% - Metaverse Game (Nano-Cap)

- NCDT +275% - Personalized Cloud Computing (Nano-Cap)

- OXO +163% - AI + Privacy on DeFi Platform (Micro-Cap)

- DEXT +90% - DeFi Trading Tool (Meme Coin) (Micro-Cap)

- DIMO +63% - Drive-to-Earn / Decentralized Driver Network (Micro-Cap)

Monthly Altcoin Pick:

We will be releasing our Altcoin Pick for May at the end of the month. If you would like access to this Altcoin Pick and future ones, please consider becoming a member. Altcoin picks are emailed to members as soon as they are published and this is the strategy we use for choosing them.

Our Altcoin Picks for the prior months can be found here.

If you would like to support this publication and have access to member benefits, such as our monthly Altcoin Pick, signup here.

Thanks and appreciation to all our members!

Until the next report,

Richard